8 new search features delivering more motivated movers

19 Sept 2025Our latest innovations are designed to maximise conversion from high-intent property searchers, directly driving value for our partners.

Read more

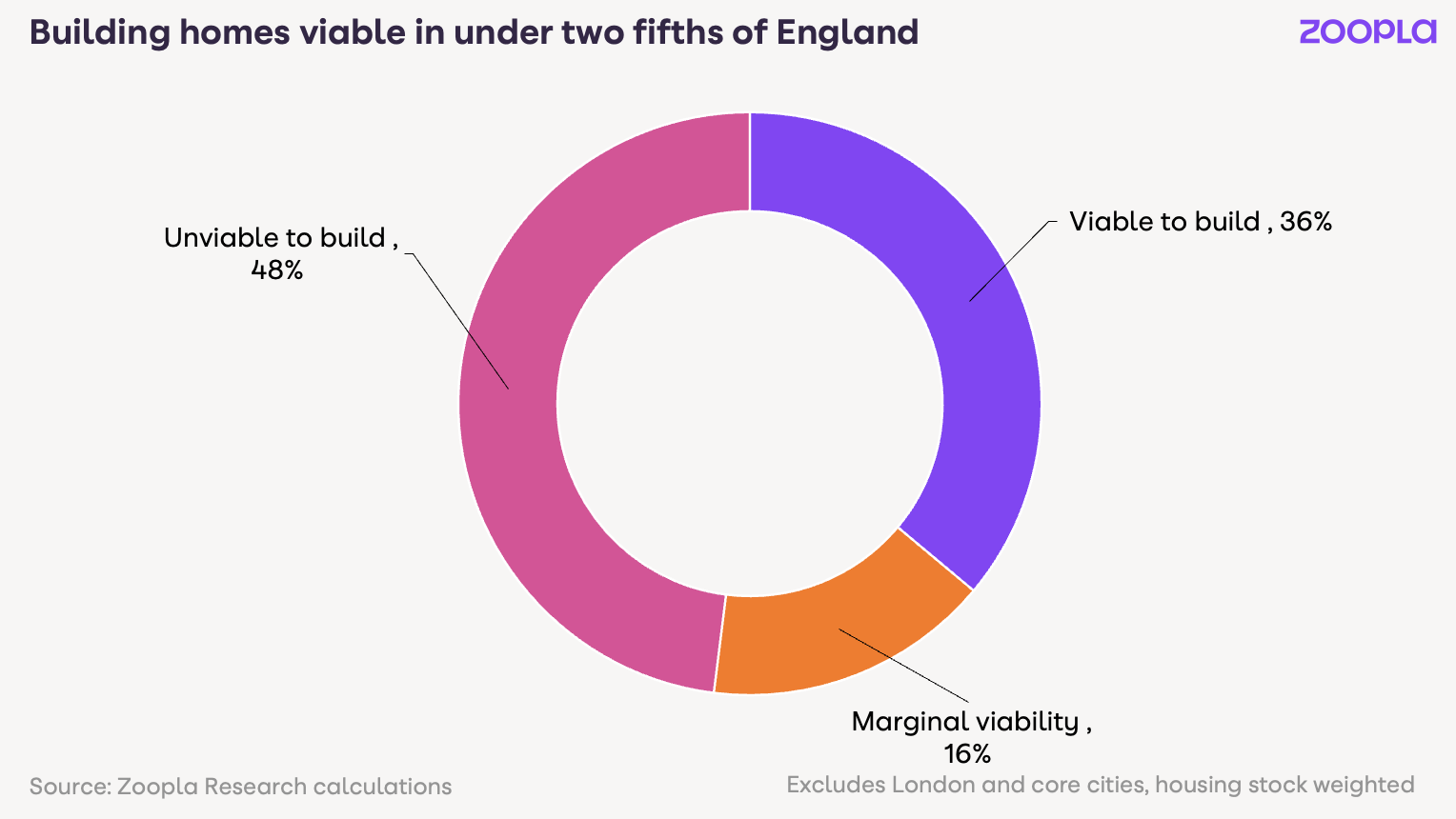

Our Viability of Homebuilding Report reveals that building homes is not currently financially viable across 48% of the country, leading to four key reform recommendations that will support the new homes industry to increase housing delivery and build more homes.

Building homes is not currently financially viable across 48% of England and deemed challenging across almost two-thirds of it (64%).

There is a disconnect between viability to build and affordability for homebuyers - making it most difficult to deliver new homes in places where buying homes is more affordable.

We’re presenting our recommendations to policymakers to support the pursuit of sustained increase in housing supply across the country.

Our recommendations focus on planning reform, impact review of any new regulatory changes, targeted funding to unlock affordable housing supply now and the reintroduction of carefully designed first-time buyer support.

While there are no silver bullets for the viability of development, we can help builders support and improve sales rates today - increased investment in our new homes product has delivered a 30% year-on-year uplift in quality leads for housebuilders.

Building more homes is vital for tackling the UK’s housing shortage. But the viability of building is a serious obstacle: costs have risen faster than sales values, demand has shifted and the market needs more support to unlock greater housing delivery.

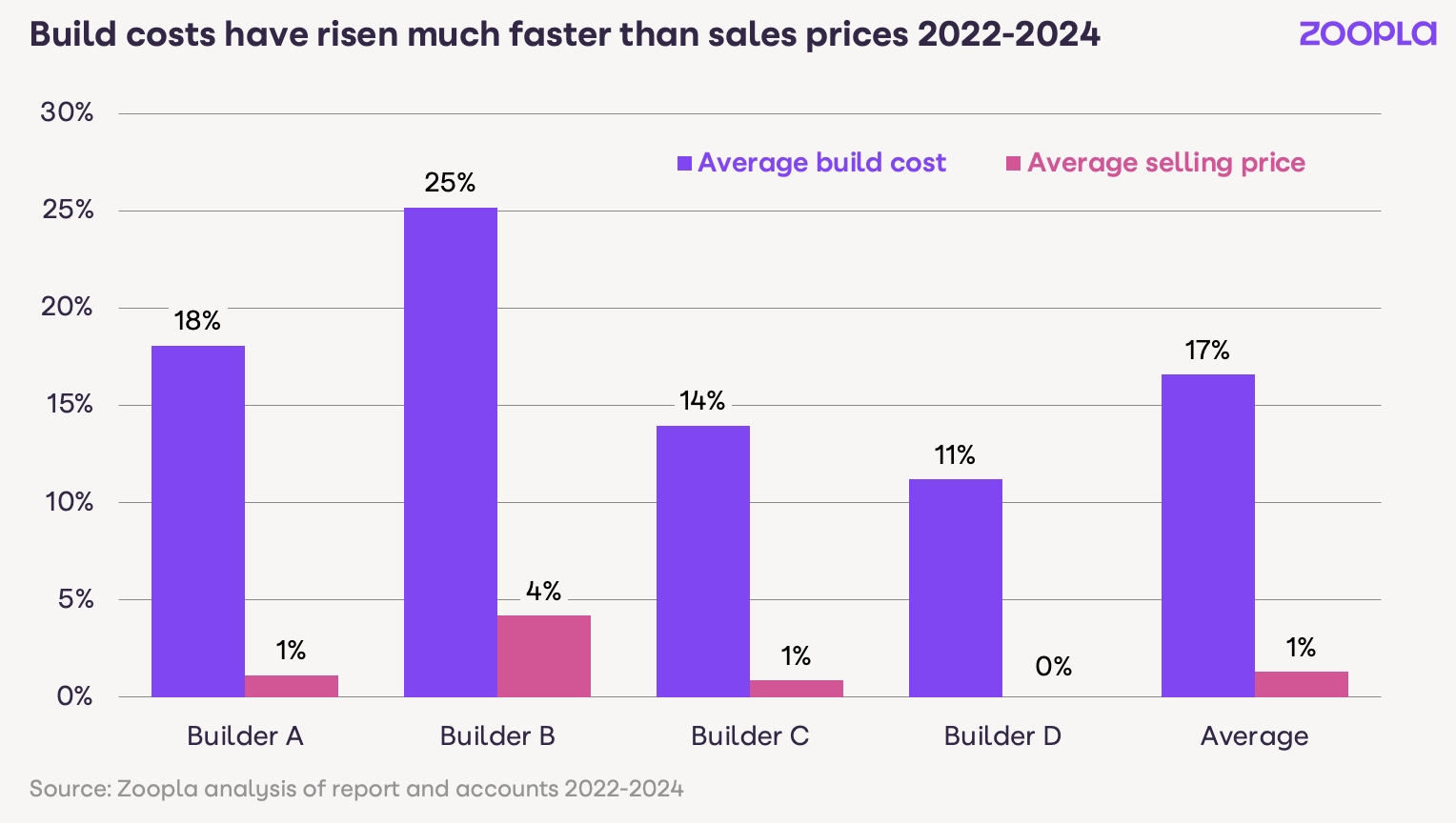

Our latest research highlights the challenges housebuilders face in 2025, with build costs 17% higher than in 2022 and sale prices up just 1%. The government says it wants to ‘build baby build’, but our analysis shows this is only possible across half the country – and often only in the least affordable markets for homebuyers.

With fewer starts, fewer planning applications and a tough demand backdrop, it’s clear that significant reform is needed to enable housebuilders to increase investment in growing housing delivery.

The report uncovers the viability gap for housebuilders, casting serious doubt over current housing targets - and makes four key recommendations to support policymakers in enabling greater delivery of new homes each year.

Download the Viability of Homebuilding Report (PDF, 1.79MB)

While the government can’t control the price of raw materials like bricks or concrete, it can influence the rising costs of new regulations alongside other measures to support demand for new homes - from private buyers and corporate investors.

We aim to help enable significant reform that boosts capacity and speed at the local planning level and sees new funding allocated to enable immediate delivery.

While government action is vital, there are also steps housebuilders can take to reach buyers in a market where viability is low and buyer affordability is stretched.

Our investment in new home innovations has delivered a 30% increase in new homes applicants in the last year, providing vital visibility and lead volumes to housebuilders in tougher market conditions.

Enhanced visibility: We’ve boosted how new homes are displayed in search to help housebuilders reach the 70% of buyers who are open to new builds but not explicitly searching for them.

Smarter targeting: We’ve developed intuitive ways to showcase new homes to the right buyers, including those looking further afield due to affordability pressures.

Efficient cost-effective marketing: We’ve introduced new high-return marketing solutions that help de-risk the sales process for housebuilders.

Extensive buyer reach: More than 9 million people use Zoopla every month, generating more than one billion property searches a year - giving housebuilders more opportunities to reach the right buyers.

Our mission is to help builders navigate the challenging environment by connecting your properties with serious homebuyers. We give you the tools to connect with more quality buyers, keep sales rates moving and protect your pipelines.

Find out how we connect housebuilders with more motivated movers.

The greatest risk to increased delivery is that the costs of delivering new homes continues to rise faster than sales values.

Since 2022, the cost of delivering a new home has jumped 17%, while house prices have risen by just 1% - widening the financial viability gap for housebuilders.

As well as increased material and labour costs, housebuilders face increased costs from:

Higher borrowing costs

Extra expenses linked to policy changes, such as the Building Safety Levy and the upcoming Future Homes Standard.

Importantly, these costs are unlikely to be recovered through general house price inflation which is slowing and where affordability is a key factor..

For smaller builders – who account for nearly a third of all new homes – the squeeze is even tighter as they lack the advantage of scale.

Two-thirds (64%) of southern England have house prices that can support the cost of delivering new homes, compared to just 13% in the Midlands and 10% in the North.

This creates a disconnect between the places where new homes can be built and the areas with the highest levels of new homes demand.

In the Midlands and the North of England, just 13% and 10% of areas respectively are viable for new homes developers, leaving many local markets with demand but no reasonable path to deliver more homes.

This creates a frustrating paradox: Where it’s viable to build, homes are often out of reach for local buyers. Where homes are affordable for buyers, it’s rarely viable for builders to deliver them.

What’s more, in areas where development is viable the differentials between cost and sales values are relatively small. This highlights the sensitivity of housing development to increasing costs of delivery.

Demand for new homes has weakened since the end of Help to Buy in 2022 and the rise in mortgage rates.

Demand is lower in the most viable markets due to stretched affordability for homebuyers, limiting the pool of potential demand for new homes.

Demand from housing associations - who buy up to a quarter of larger developers’ homes through Section 106 agreements - has weakened in the face of well-documented challenges relating to building safety, cladding and maintenance programmes, as well as borrowing costs.

If the UK is to start delivering more homes then change is essential. Our report recommends four key steps:

Planning reform: Simplify and speed up the system for housebuilders.

Regulatory review: Cut back unnecessary cost burdens in developing new homes.

Targeted funding: Give housing associations the backing they need to keep buying new stock.

Demand support: Reintroduce targeted help for first-time buyers, carefully designed to avoid inflating prices across the board.

The economics of housing development are complex. In summary, improving viability could be achieved by either reducing the costs of development or by rising sale prices, but we must avoid reliance on higher prices to repair building viability.

The demand is certainly there from owners and renters to occupy 300,000 new homes a year. It’s how industry and policy makers work together to seize the opportunity to grow housing supply and improve the viability of housing development.

From Featured Developments to In-Search Ads, explore our suite of tools designed to amplify your reach and accelerate plot sales.

We try to make sure that the information here is accurate at the time of publishing. But the property market moves fast and some information may now be out of date. Zoopla accepts no responsibility or liability for any decisions you make based on the information provided.

Our latest innovations are designed to maximise conversion from high-intent property searchers, directly driving value for our partners.

Read more

A major vote of confidence in the strength of our new homes innovations and their strategic impact on ROI.

Read more

Buyers are returning to the housing market as confidence improves and mortgage rates fall, but a growing number of homes for sale is giving more choice and reshaping market conditions across the country.

Read more