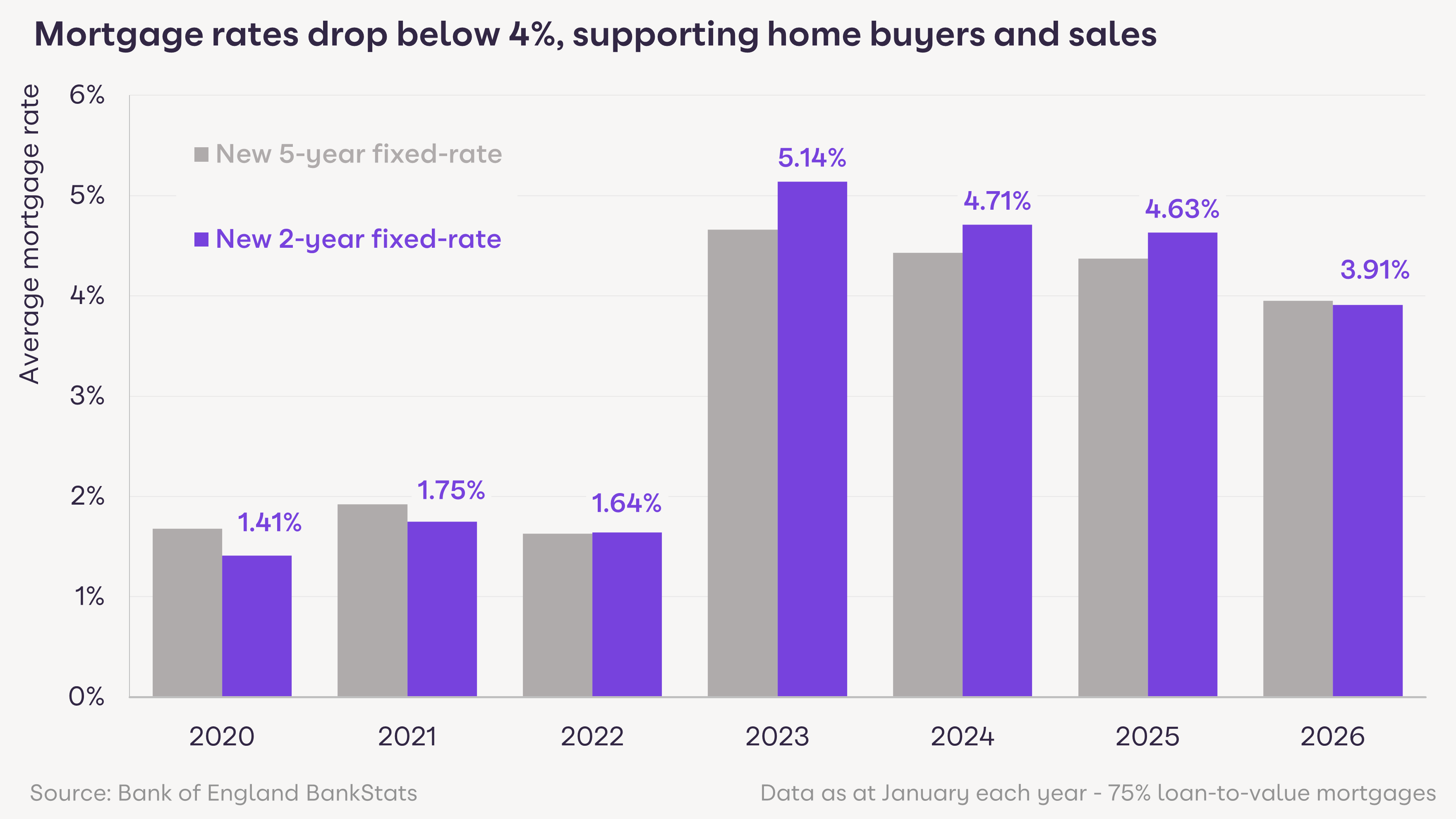

Lowest mortgage rates in 4 years supporting sales

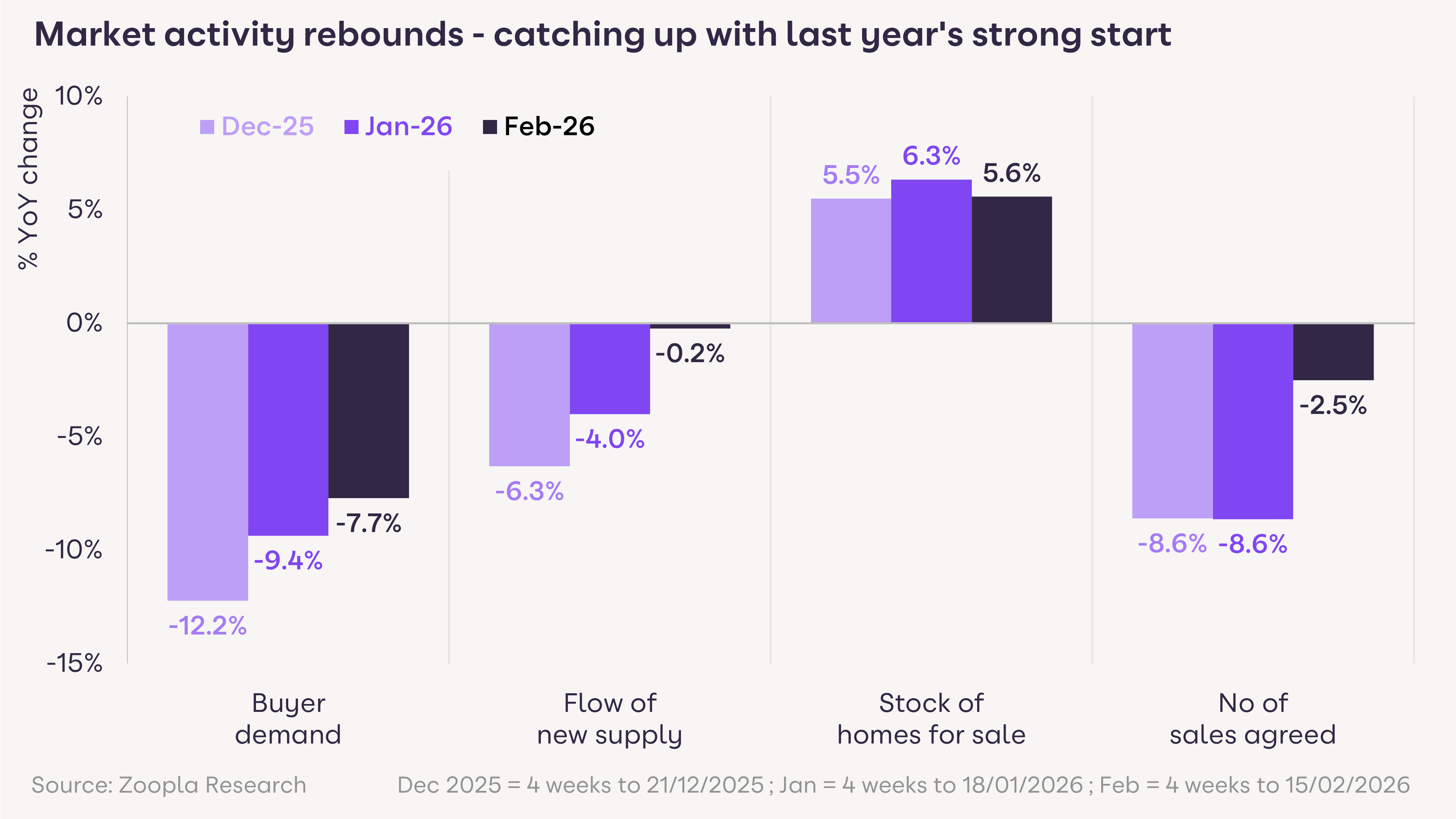

Healthy transaction activity is supported by falling base rates and strong competition between lenders.

Average mortgage rates for new loans fell to their lowest level in 4 years in January. Rates on both 2-year and 5-year fixed deals are now below 4% for the first time since 2022, providing a significant boost to the market.

While the base rate is likely to be cut again this year, brokers suggest mortgage rates are unlikely to fall much further. Even so, agents can confidently advise buyers that they currently have access to some of the lowest rates seen for several years, particularly those with larger deposits.

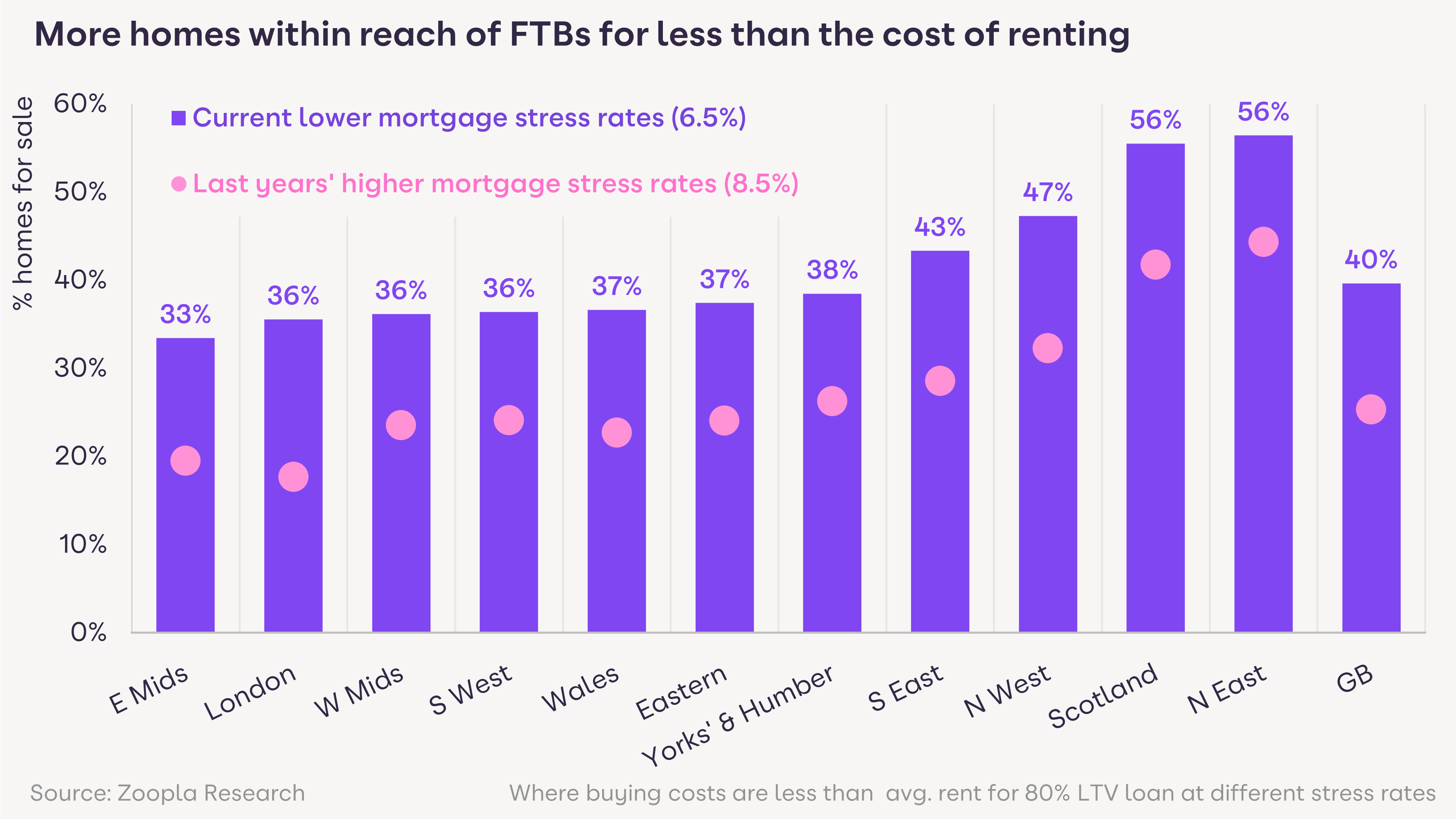

More homes to buy for less than the cost of rent

A major development over the past year - and a key marketing angle for agents targeting tenants - is how mortgage lenders assess affordability, particularly the ability of a borrower to afford higher mortgage rates in the future.

Lenders are typically assessing the ability to pay a 6.5% mortgage ‘stress rate’. This rate sat at 8.5% last year.

Lower stress rates mean agents can now share that 40% of homes currently for sale (on Zoopla) are cheaper to buy with a mortgage than to rent locally. This is a massive jump from just 25% of homes when tested against the higher stress rates a year ago.

These changes have delivered the strongest improvement in first-time buyer affordability since 2022, providing agents with a prime opportunity to drive first-time buyer interest.

Regionally, more than half of homes for sale are cheaper to buy than rent in the North East and Scotland, followed by the North West. In contrast, higher house prices in London and the Midlands mean that fewer than 40% of homes offer this dynamic, requiring different marketing strategies.

These changes benefit all buyers using a mortgage, supporting higher transaction values and house price growth, particularly across northern England and Scotland. The impact is more limited across southern regions, where agents must help buyers navigate higher stamp duty costs, an increasingly costly financial hurdle.

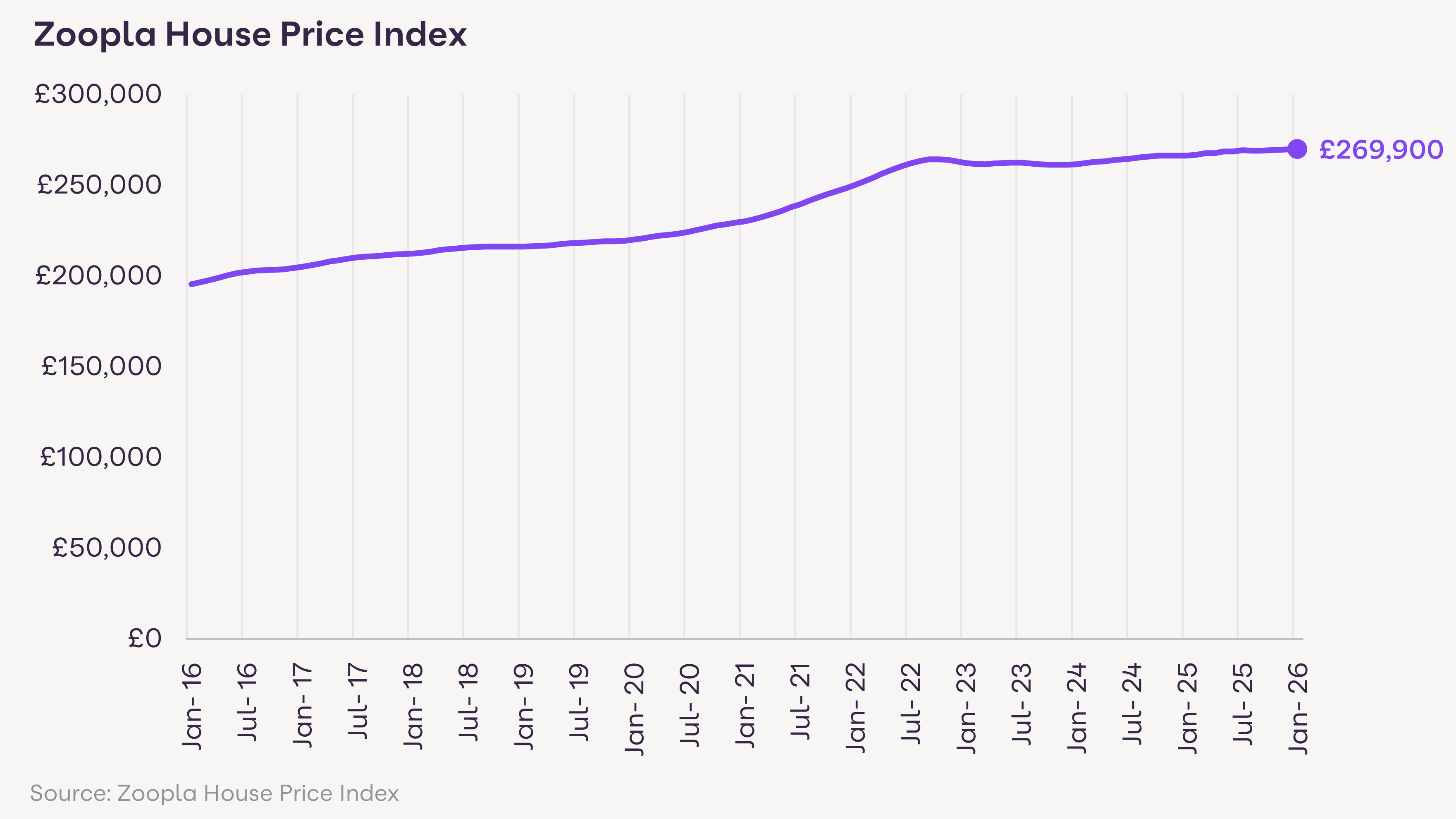

House prices firming on improved affordability

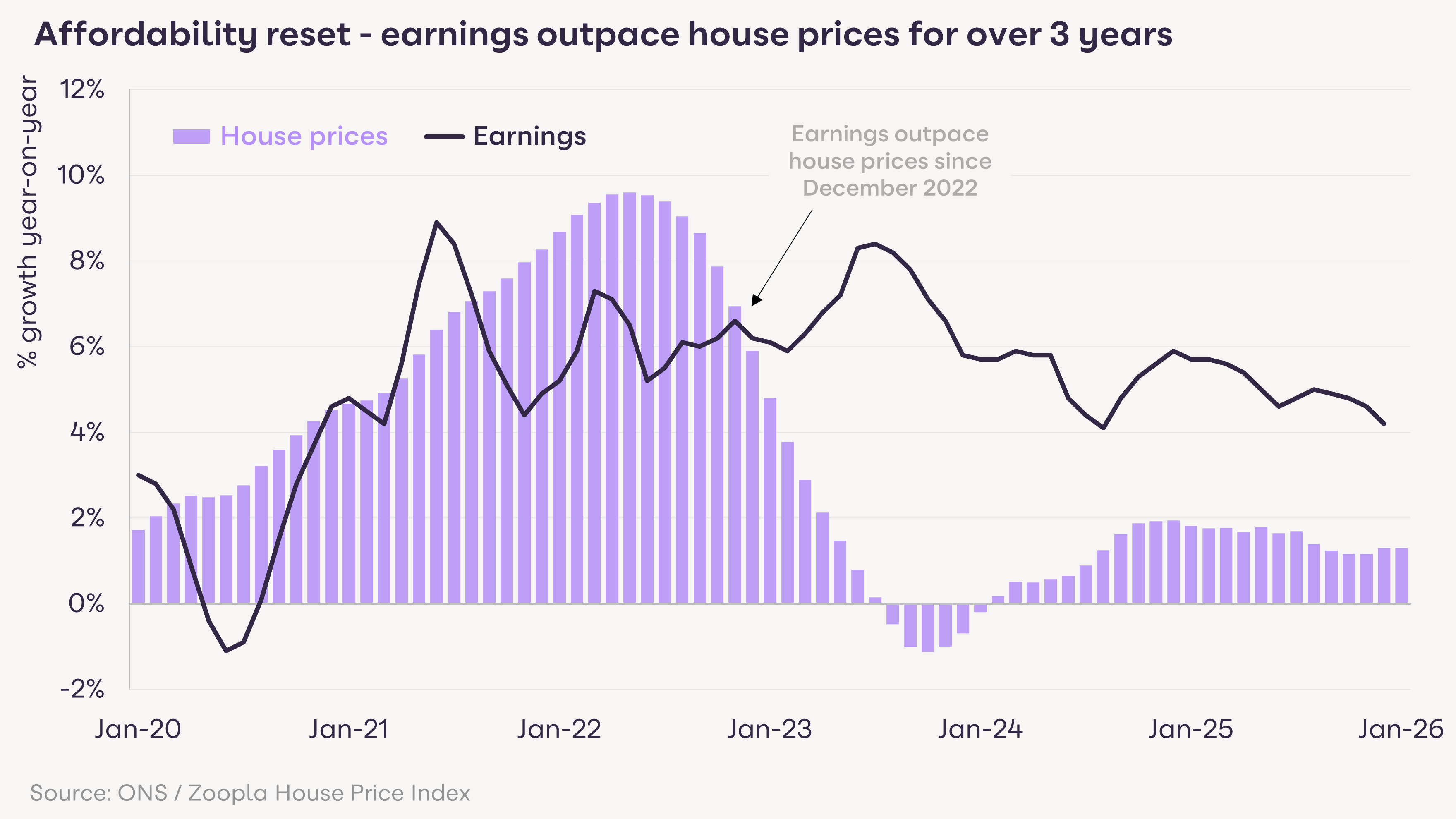

Average earnings have grown faster than house prices for the last 3 years. Alongside lower mortgage rates and relaxed affordability testing, this further improves housing affordability and heavily supports sales volumes across the industry.

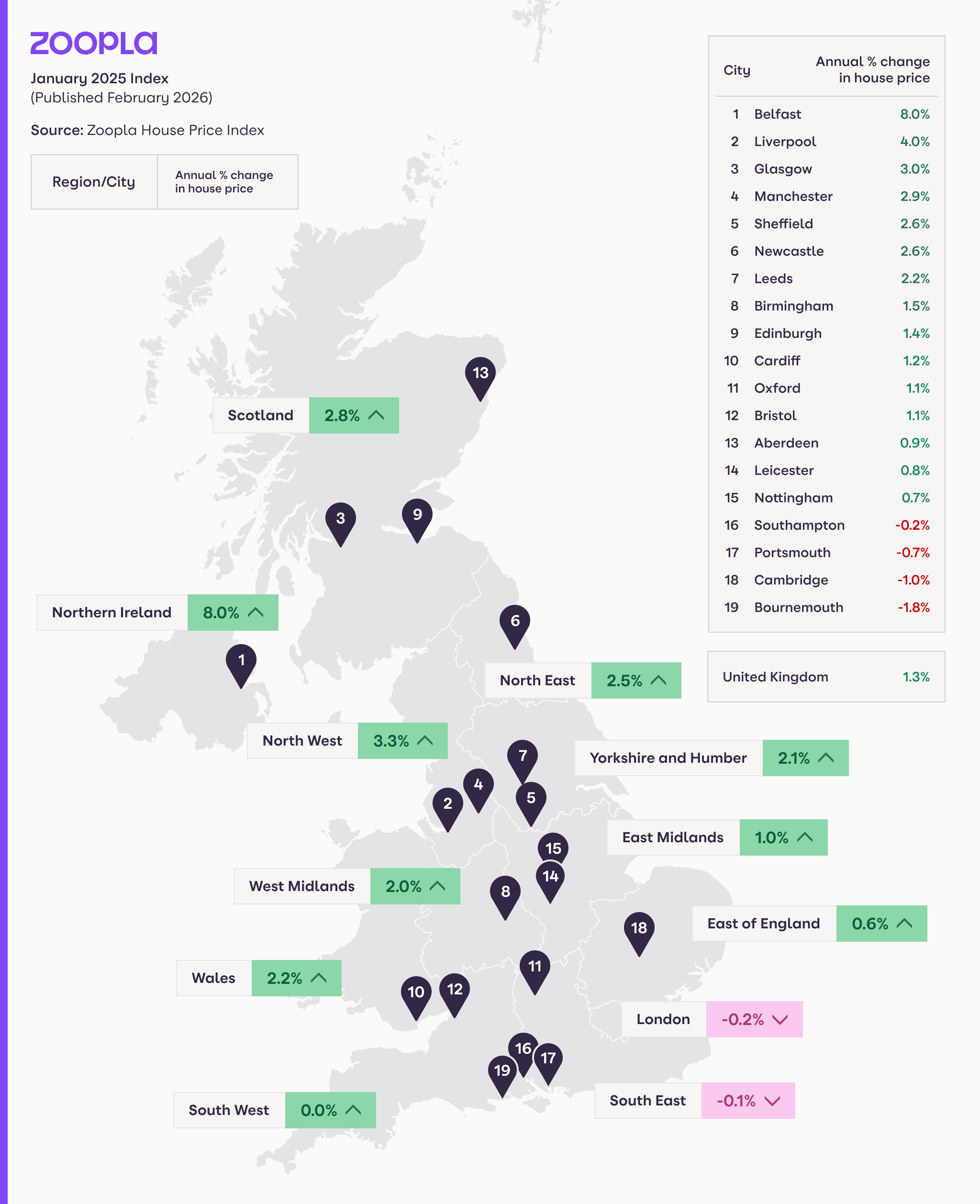

Annual house price growth is higher than a year ago in 4 areas: the North West, Scotland, the North East and Northern Ireland. These markets are more affordable and have fewer homes for sale than a year ago, limiting buyer choice and giving more scope for above-average house price increases.

Across the rest of the UK, house price growth is the same or weaker than a year ago. In southern England, house prices are unchanged over the last 12 months. This stability is a marked improvement on the widespread house price falls seen over the second half of 2025.

However, affordability pressures and higher stamp duty costs continue to weigh on demand in southern regions. This is compounded by increased inventory, with up to 16% more homes available in some areas. As a result, we forecast that price growth is likely to remain modest through 2026.

Agents in southern England must have frank conversations with vendors planning to move this year; they will need to price realistically to secure a timely sale. Negotiators should ensure sellers factor this reality into the offers they make on their onward purchases to keep chains intact.

What’s next for the UK housing market in 2026?

The housing market is seeing improved levels of transaction activity alongside subdued house price inflation. This is good news for market liquidity and represents a much more stable trading environment for estate agencies. Market conditions have improved, but some economic headwinds remain.

We expect continued modest rates of price inflation over 2026. This will support healthy pipelines with wide variations across local markets, reinforcing that the advice of local agents is absolutely essential in setting the right pricing strategy to get vendors moved.