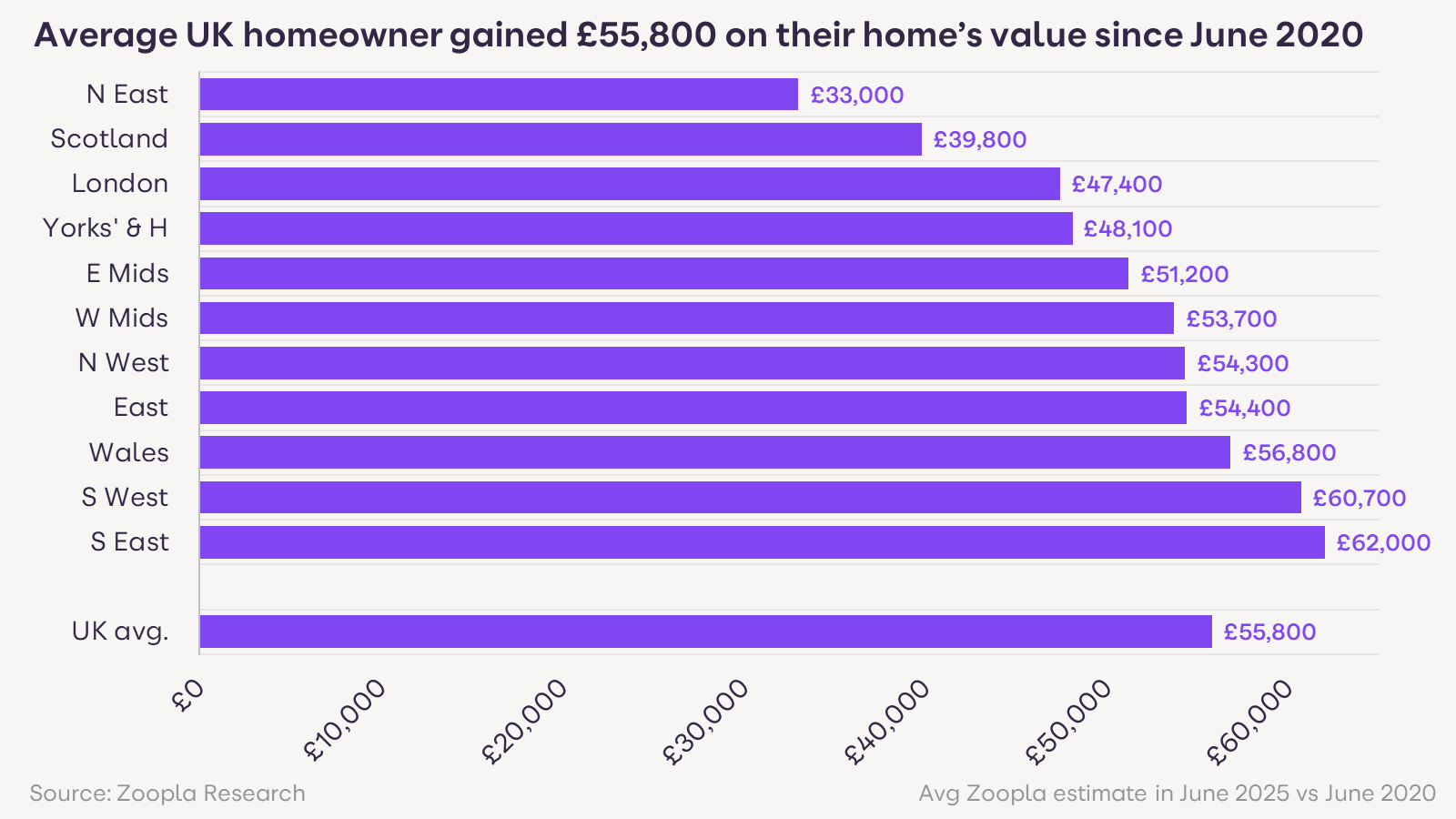

Regional breakdown: Home value growth in your region

Understanding where these gains are concentrated can help identify new instructions and set realistic asking prices. Let’s dive into the high-growth affordable markets in the north and Wales, and the slower growth - but big cash boosts - in the south.

The North West, Yorkshire and the Humber, and Wales have seen the strongest value growth since June 2020. They have the highest proportion of homes with 50%+ value gains in 5 years, and also make up the most UK homes with this level of gains.

The North West topping the table is in line with other trends we're seeing right now, with the region recording the highest sale numbers and the strongest rise in sale prices. High mortgage rates and rising rents have encouraged home buyers to seek out value for money in localised markets, and the North West is proving particularly resilient to market challenges.

Region | % of homes increasing in value by over 50%

| Average value of these homes in June 2020 | Average value of these homes in 2025 | Average value change of these homes 2020-25 |

North West | 12% | £122,200 | £199,300 | £77,100 |

Wales | 11% | £140,100 | £230,800 | £90,700 |

Scotland | 6% | £129,900 | £222,900 | £93,000 |

Yorkshire and The Humber | 6% | £129,300 | £215,500 | £86,200 |

North East | 5% | £99,500 | £168,700 | £69,200 |

UK | 5% | £167,900 | £285,300 | £117,400 |

East Midlands | 4% | £163,000 | £277,300 | £114,300 |

West Midlands | 4% | £166,900 | £278,200 | £111,300 |

South West | 3% | £287,200 | £503,500 | £216,300 |

South East | 2% | £387,700 | £687,300 | £299,600 |

East of England | 2% | £292,700 | £518,800 | £226,100 |

London | 1% | £454,100 | £825,100 | £371,000 |

It’s a different story in the south, with weaker value growth and some modest price falls in inner London. However, low value rises can still translate to big cash boosts here due to higher house prices.

51% of southern homes have gained up to 20% in value in the last 5 years, with this group gaining £62,000 on average.

The rise in mortgage rates has gone further in impacting demand in the south, limiting first-time buyer affordability and discouraging landlord investment.

Value losses have mainly been seen in London, where 13% of homes have lost 5% or more - an average of £34,000. Almost half of all homes in Westminster and Kensington & Chelsea are now worth less than in June 2020.