Zoopla UK Rental Market Report: June 2025

11 Jun 2025The rental market boom is over according to our latest report, here's everything you need to know about today's rental market.

Read more

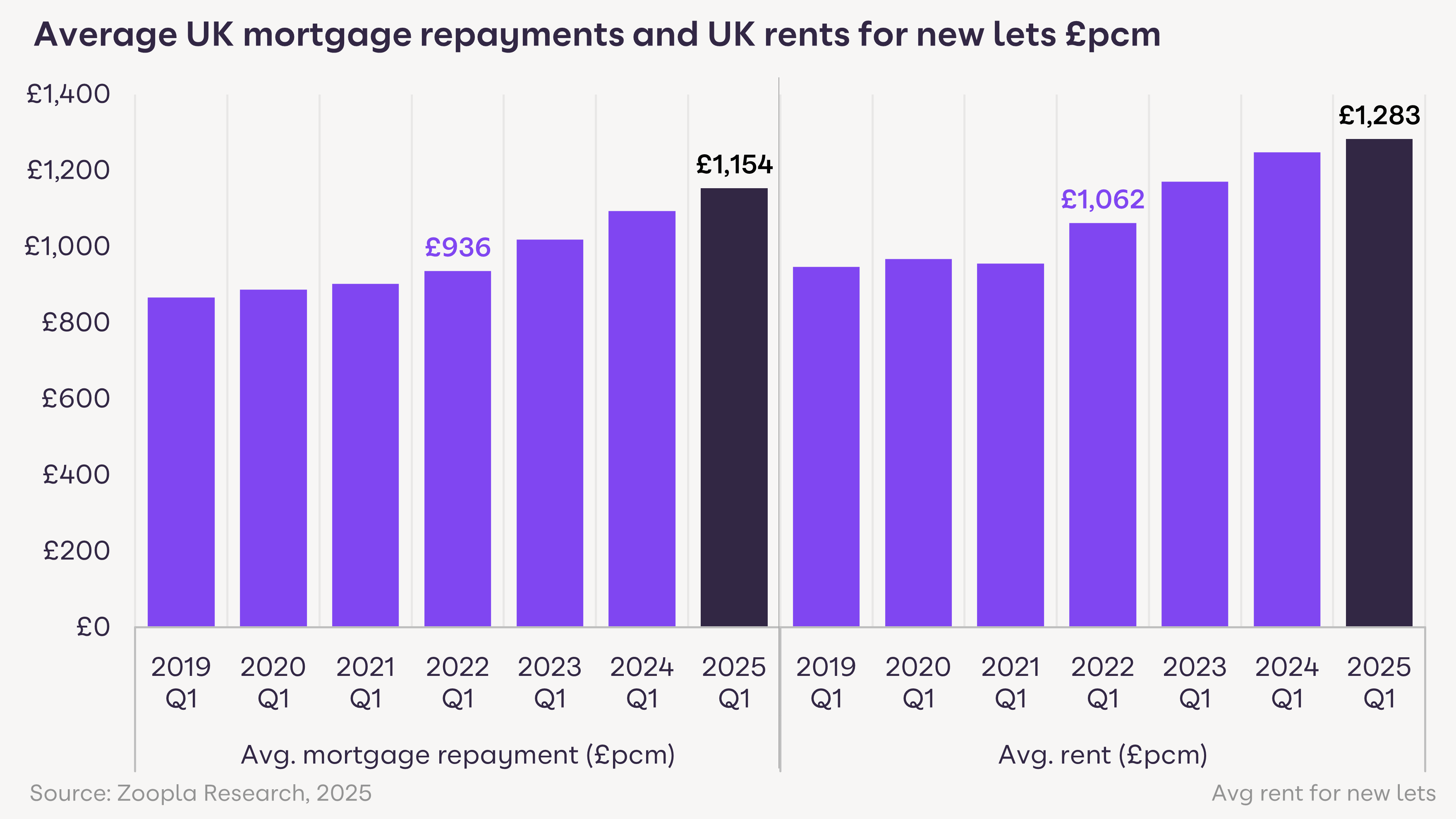

Over the last three years, rents have seen a greater increase than mortgage repayments. Find out what you need to do to stay ahead in the lettings market.

Rents for new lets have risen by £221pcm since 2022, outpacing the £218pcm rise in mortgage repayments

Average UK rents now stand at £1,283pcm, higher than the average mortgage repayment of £1,154pcm

Rents have surged by over 30% in areas like Oldham (+35%), Wigan (+32%) and Bolton (+31%) since 2022

Rental inflation is at a four-year low, but demand remains high due to limited supply and affordability pressures

Letting agents should help landlords review rents, consider high-growth areas, while keeping tenant affordability in mind

Our latest analysis reveals that rents have increased more than mortgage repayments, since 2022. Average rents are sitting higher than mortgage repayments for an average outstanding loan, at £1,283 per month and £1,154 per month respectively. And, over the last three years, rents for new lets have risen by £221pcm, with mortgage repayments increasing by £218pcm.

For letting agents, now is an ideal time to review rents to make sure they reflect current market trends. Leveraging Zoopla's market data can help ensure properties are competitively priced to maximise income while attracting quality tenants.

Some areas have seen particularly strong rent increases, with rental demand significantly higher than supply. In places like Oldham, Wigan, and Bolton, rents have surged by over 31% in three years as rents, increasing off a relatively low base.

Rents are highest in London with these areas registering the largest monetary increases, up by up to £400pcm over the last three years. The greatest increases can be seen in more affordable areas in outer London such as Ilford in East London.

Make sure you’re advising landlords on expanding their portfolios by investing in these high-growth areas and reviewing underperforming properties with a data-driven approach. With this, you can help landlords understand if a property's lower growth is due to location, condition or pricing, and advice on potential upgrades or strategic adjustments.

Postal area | Rent £pcm Mar-25 | % change 2022-2025 | £pcm change 2022-25 | £pa change 2022-25 |

Oldham - OL | £876 | 35% | £227 | £2,724 |

Wigan - WN | £800 | 32% | £194 | £2,328 |

Bolton - BL | £884 | 31% | £211 | £2,532 |

Falkirk - FK | £881 | 31% | £207 | £2,484 |

Walsall -WS | £893 | 30% | £206 | £2,472 |

Wolverhampton -WV | £911 | 30% | £209 | £2,508 |

Paisley - PA | £763 | 29% | £170 | £2,040 |

Tweeddale - TD | £635 | 29% | £143 | £1,716 |

Dudley - DY | £878 | 28% | £190 | £2,280 |

Ilford - IG | £1,794 | 28% | £395 | £4,740 |

Kirkcaldy - KY | £717 | 28% | £156 | £1,872 |

Romford - RM | £1,611 | 28% | £356 | £4,272 |

Carlisle - CA | £664 | 27% | £140 | £1,680 |

Edinburgh - EH | £1,166 | 27% | £248 | £2,976 |

Luton - LU | £1,208 | 27% | £258 | £3,096 |

Blackburn - BB | £688 | 26% | £141 | £1,692 |

Manchester - M | £1,176 | 26% | £239 | £2,868 |

Medway - ME | £1,239 | 26% | £254 | £3,048 |

Motherwell - ML | £721 | 26% | £148 | £1,776 |

Newcastle - NE | £853 | 26% | £177 | £2,124 |

Slough - SL | £1,599 | 26% | £326 | £3,912 |

Source: Zoopla Rental Index 2025

The rise in the costs of renting since 2022 is down to a surge in rental demand, following the pandemic. This boost in rental demand has been largely impacted by a strong labour market and higher levels of migration for work and study. Over 2022 and 2023 Mortgage rates spiked, making it harder to buy homes. This caused many first-time buyers to remain in the rental market for longer, further boosting demand and suppressing supply, pushing rents higher.

Stronger growth in wages over the past three years has supported rising rents. However, lower-income renters and those on state support continue to face affordability pressures. Rental inflation for new lets has now slowed to a four-year low, as demand eases due to lower migration and improved conditions for first-time buyers. Rental affordability is also limiting the pace at which rents can increase.

Despite higher mortgage costs, homeowners have been protected by tougher mortgage regulations introduced in 2015, which ensured borrowers could afford higher rates in future. In light of ongoing policy changes, positioning yourself as an expert in navigating new regulations (like the upcoming Renters' Reform Bill or potential EPC requirements) will be crucial for landlord confidence and retention.

One advantage for mortgagees over renters is that their monthly repayments go towards covering both interest costs and the repayment of the loan, which reduces slowly over time. For renters, tougher access to home ownership if keeping demand for rental homes high, with limited landlord investment continuing to restrict supply, keeping a steady upward pressure on rents.

This data underscores the critical need to both retain existing landlords and attract new business. Highlight the strong demand and potential for robust yields to encourage landlords either into the market or to use your services.

With ongoing supply-demand imbalances, it’s important to keep tenant affordability front of mind when advising landlords on rental pricing. Balancing competitive rents with tenant needs is crucial to maintaining steady rental income in today’s market. While optimising rent is key, it's worth reminding landlords that retaining good tenants through fair pricing and good management can significantly reduce re-letting costs and void periods, ultimately boosting long-term ROI.

Get more insight from our latest Rental Market Report to support your conversations with landlords, and help you make informed pricing decisions.

“A shift to higher mortgage rates raised alarm over how mortgagees would be able to afford higher repayments over the last three years. The sales market has been resilient thanks to mortgage regulations that ensured borrowers could afford higher mortgage rates. Renters have faced similarly steep increases in the cost of renting in recent years with rents pushed higher on string demand and limited supply of homes for rent which has hit lower income renters hardest.

“Rental inflation for new lets has slowed to its lowest rate for four years which will be welcome news for Britain’s private renters. The quickest way to alleviate high rents is to grow the stock of homes for rent in both the social and private rented sectors. Growing housing supply is a key Government target and it’s vital that the stock of rented homes is expanded across all tenures.”

Get in touch to find out how we can tailor a package of high-performance products around your business goals.

We try to make sure that the information here is accurate at the time of publishing. But the property market moves fast and some information may now be out of date. Zoopla accepts no responsibility or liability for any decisions you make based on the information provided.

The rental market boom is over according to our latest report, here's everything you need to know about today's rental market.

Read more

Zoopla research reveals UK homes have gained £55,800 on average since the pandemic. Discover where the biggest gains are and how the widespread rise in home equity could be a game-changer for your pipeline.

Read more

Unpacking the differences in London’s property market, and what agents need to do to stay ahead.

Read more