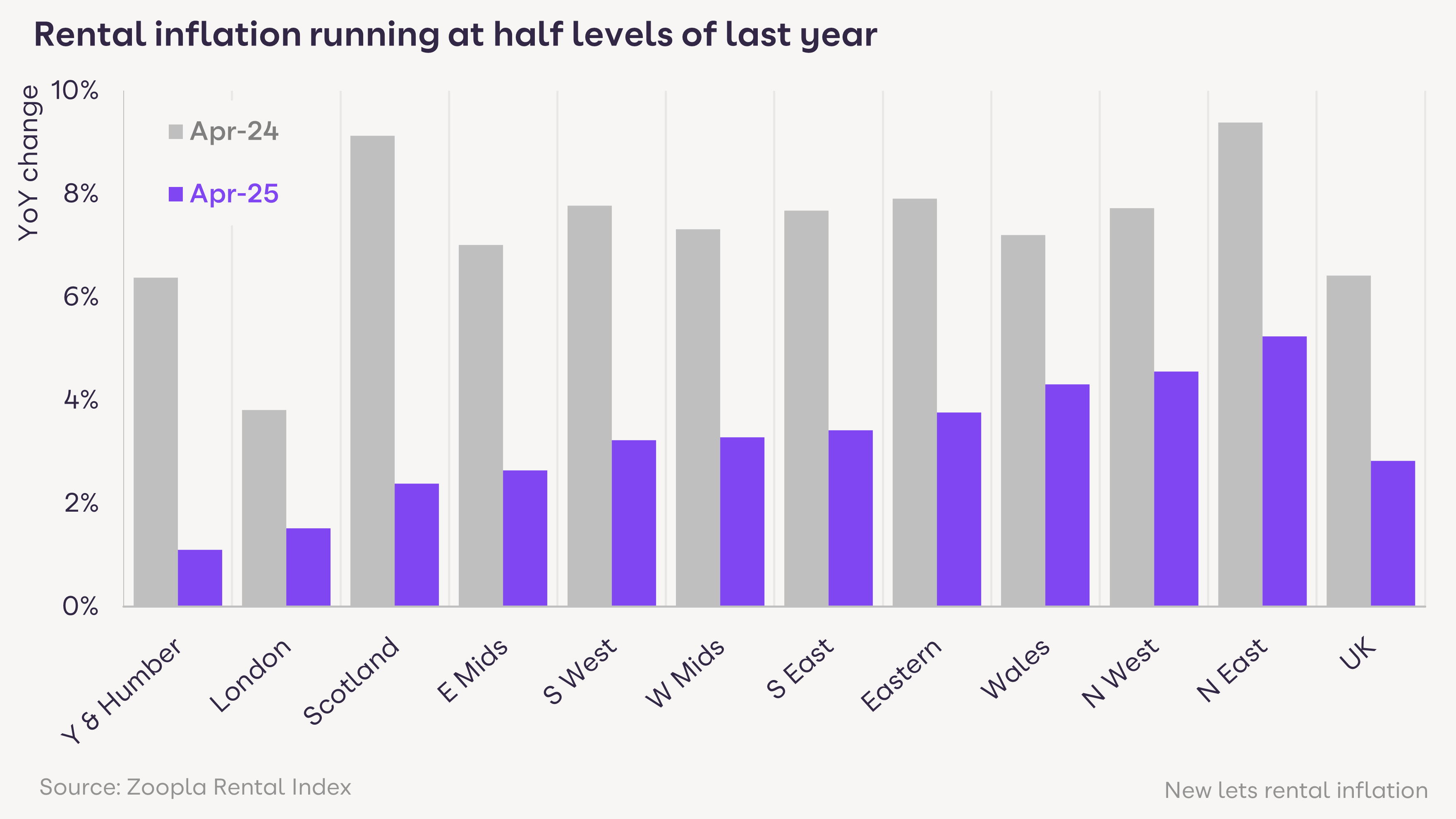

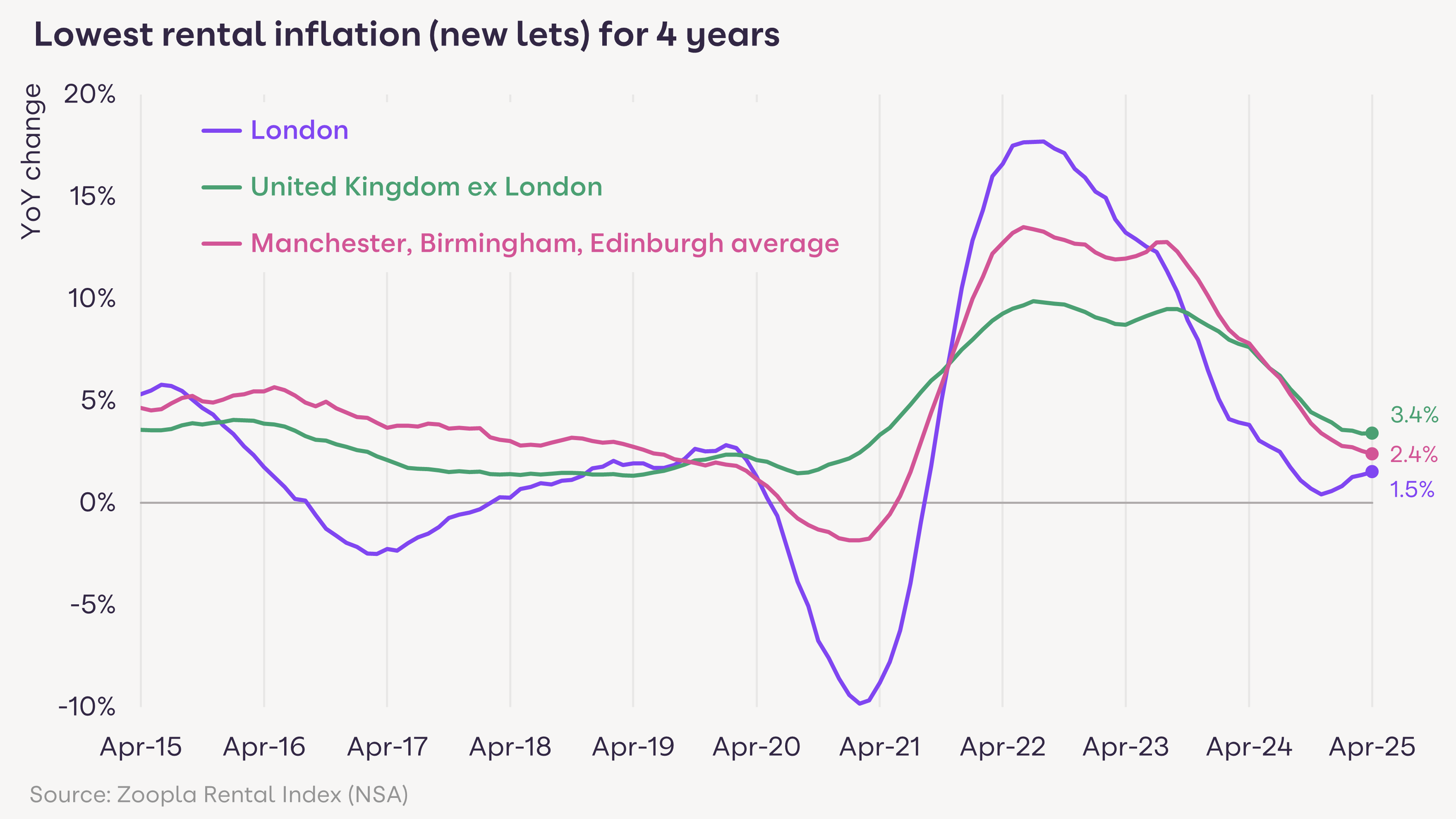

Rental inflation slows across the UK

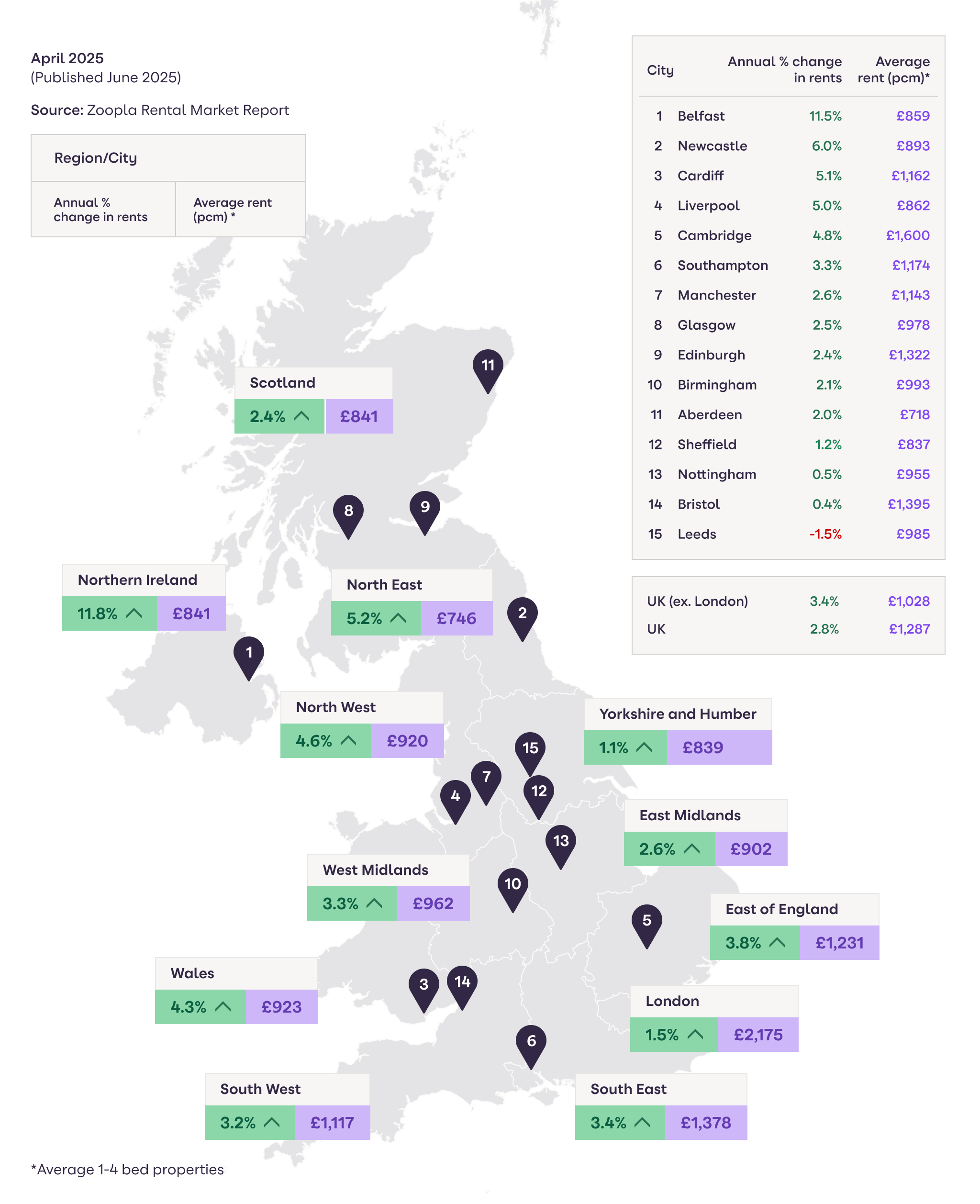

Rental inflation has slowed across the whole of the UK. Current inflation levels range from 1.1% in Yorkshire and the Humber, to 5.3% in the north East.

In Scotland, rental inflation has slowed sharply from 9.1% a year ago, to 2.4% now. With limits on how much rents can increase within a tenancy being removed, landlords and agents face less pressure to secure high rents at the start of new tenancies. Removing this form of rental control has reduced rental inflation in Scotland, alongside underlying affordability pressures.

In Yorkshire and the Humber, rental growth has also weakened. This is especially prominent in cities with a high student population. For example, rents in Sheffield, Bradford and Leeds have fallen by 1.9%, 1.4% and 1.5% respectively.

At a more local level, rents continue to rise quickly in affordable areas, often adjacent to large cities, such as Wigan (8.8%), Carlisle (8.8%), Motherwell (8.3%), Chester (8.2%) and Blackburn (8.0%).

In addition to Leeds, there are other areas with falling rents. These include North West London (-0.2%), West Central London (-0.6%) and Dundee in Scotland (-2.1%).