Renewed market momentum fuelled by improving mortgage market

25 Feb 2026The Zoopla House Price Index shows renewed activity in the housing market, presenting immediate opportunities to build instruction volumes and sales pipelines.

Read more

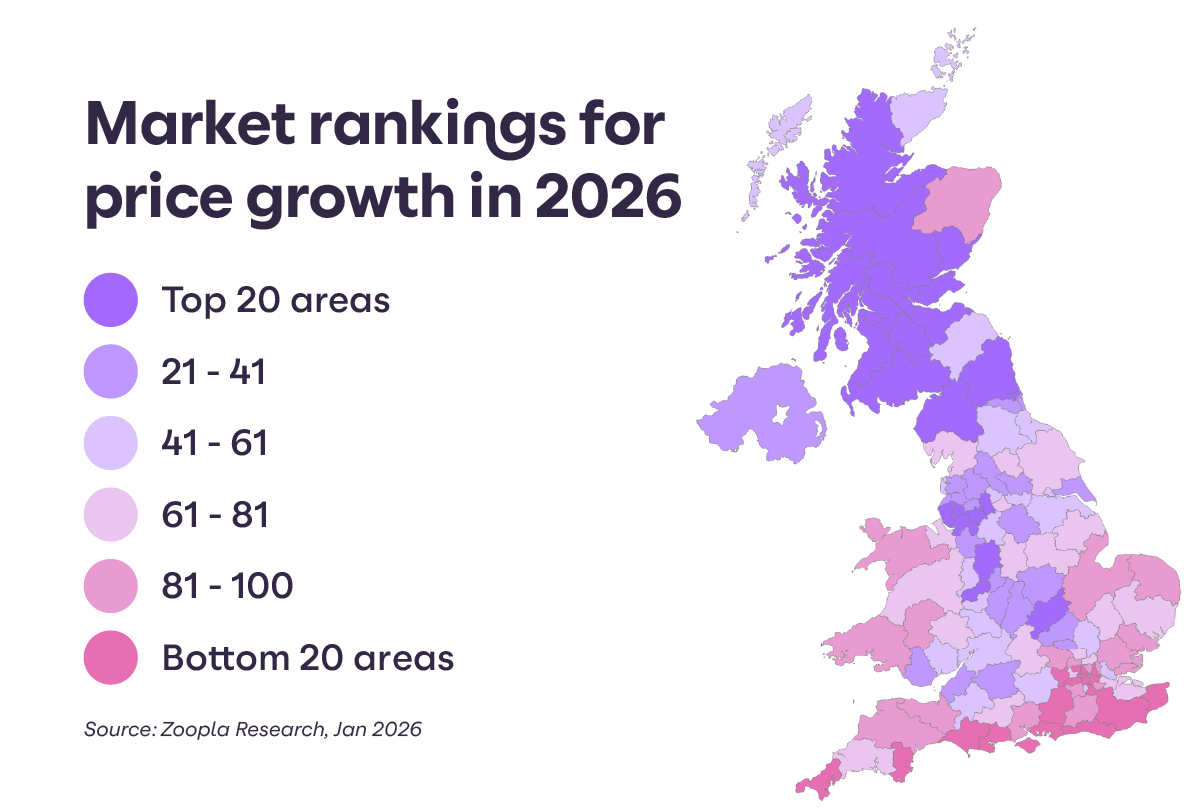

We’ve ranked every UK postcode area by its growth potential in 2026, based on key market indicators. How does your area stack up?

National averages are interesting but don’t explain local trends. In 2026, success will be dictated by hyper-local awareness and tailored sales strategies.

Scotland and the North West dominate the top 20 markets ranked for house price growth, while the South East and London require very careful pricing to ensure demand and move stock.

Time to sell is an important performance indicator for market health, revealing stark contrast between areas where homes sell in 14 days versus those sitting on the market for 60+.

There is no single housing market in the UK. Conditions vary across the country, from regions to individual towns, and a tailored local strategy is key to successful sales and agency growth in 2026.

The Zoopla Sales Market Rankings 2026 use definitive data and key market indicators to predict the strength of the sales market across 120 postcode areas in the coming year.

The aim? Arm you with detailed local market insights to help inform client conversations, win more instructions and secure sales to support your growth in your local market.

We predict that UK house prices are set to increase by 1.5% this year, but there will be a spread in the range of house price inflation across local markets. This will reflect the demand for and affordability of homes across the country, with markets in Scotland and Northern England enjoying the best prospects for growth.

In towns and cities at the top of the rankings, homes remain affordable or accessible to large employment centres, giving scope for more sales and price inflation. House prices across these areas are below the UK average and there remains a general scarcity of homes for sale.

Markets in Scotland lead the UK rankings, with just one of the top 10 coming outside the country. These markets have low levels of unsold stock meaning fewer asking price reductions and faster price growth.

Looking southward, the English market with the best prospects for 2026 is Wigan, closely followed by Liverpool and Stoke-on-Trent. Markets in the North West take up 6 out of 10 spots in the top 10, while markets beyond the North and Midlands don’t feature.

Housing markets across Southern England and London make up the list of the areas at the bottom of the rankings across the UK. This is largely down to affordability pressures resulting from higher house prices and the fact the market is still adjusting to higher mortgage rates. These markets have also seen a greater increase in homes for sale, boosting buyer choice, along with affordability impacted by higher stamp duty costs since April 2025. This explains the modest decline in average prices over the last year.

Kevin Shaw, National Sales Managing Director at Leaders Romans Group, shared his thoughts on the rankings:

“England is a patchwork of micro-markets. Every region has value pockets and premium pockets, and changing work patterns are widening where people feel they can live.

“In this report we can see ‘levelling up’ playing out and reflected in practical decisions (the political rhetoric having been forgotten). Better connectivity, stronger local economies and more flexible working post-Covid are widening options for buyers, renters and employers alike. In many cases, it makes the length and breadth of the country an option regardless of where employment HQs are located.

“In 2026, the winners won’t be regions - they’ll be the households that understand their local market and move decisively."

Stop guessing and start growing. Our team can help handpick the right products to win more business in your local market.

UK rank | Postal area | Average house price | Annual price growth | Days to sell | % homes with asking price cut 5%+ | % homes on market for 6m+ |

1 | Motherwell | £134,700 | 3.4% | 14 | 7% | 8% |

2 | Glasgow | £163,600 | 3.0% | 14 | 6% | 4% |

3 | Paisley | £139,500 | 3.4% | 17 | 7% | 13% |

4 | Falkirk | £170,600 | 4.2% | 14 | 5% | 8% |

5 | Kirkcaldy | £171,400 | 4.2% | 17 | 6% | 13% |

6 | Edinburgh | £251,500 | 1.7% | 14 | 6% | 9% |

7 | Kilmarnock | £126,200 | 2.4% | 22 | 11% | 13% |

8 | Perth | £206,200 | 3.1% | 25 | 8% | 22% |

9 | Inverness | £207,100 | 3.5% | 24 | 6% | 23% |

10 | Wigan | £175,800 | 3.0% | 32 | 9% | 19% |

11 | Liverpool | £177,400 | 3.5% | 33 | 7% | 24% |

12 | Stoke-on-Trent | £189,800 | 2.8% | 32 | 8% | 23% |

13 | Wolverhampton | £208,700 | 3.2% | 26 | 9% | 20% |

14 | Newcastle upon Tyne | £167,700 | 2.8% | 31 | 10% | 20% |

15 | Carlisle | £184,500 | 4.0% | 27 | 9% | 22% |

16 | Dumfries | £151,800 | 1.3% | 30 | 9% | 24% |

17 | Dundee | £149,400 | 2.1% | 27 | 12% | 17% |

18 | Northampton | £260,100 | 0.7% | 44 | 8% | 20% |

19 | Oldham | £184,000 | 4.4% | 37 | 10% | 22% |

20 | Manchester | £224,700 | 1.9% | 30 | 9% | 25% |

21 | Warrington | £231,300 | 2.9% | 37 | 9% | 23% |

22 | Sunderland | £121,100 | 1.9% | 34 | 12% | 22% |

23 | Leeds | £224,800 | 2.3% | 30 | 9% | 23% |

24 | Bradford | £169,400 | 2.9% | 33 | 11% | 24% |

25 | Belfast | £192,700 | 6.5% | 32 | 5% | 30% |

26 | Preston | £204,600 | 2.7% | 31 | 9% | 26% |

27 | Bolton | £197,300 | 2.6% | 33 | 10% | 23% |

28 | Sheffield | £180,600 | 2.1% | 30 | 11% | 22% |

29 | Coventry | £263,400 | 1.3% | 35 | 9% | 22% |

30 | Hull | £151,900 | 0.5% | 41 | 9% | 27% |

31 | Durham | £146,400 | 1.7% | 23 | 14% | 20% |

32 | Walsall | £222,500 | 3.1% | 26 | 9% | 22% |

33 | Blackburn | £157,400 | 3.9% | 35 | 11% | 21% |

34 | Birmingham | £234,900 | 1.2% | 31 | 9% | 26% |

35 | Cardiff | £217,400 | 2.1% | 36 | 9% | 25% |

36 | Bristol | £342,400 | 0.8% | 22 | 9% | 19% |

37 | Crewe | £248,400 | 2.6% | 37 | 9% | 25% |

38 | Swindon | £306,900 | 0.8% | 38 | 10% | 22% |

39 | Milton Keynes | £332,700 | 1.0% | 31 | 10% | 23% |

40 | Leicester | £256,800 | 1.4% | 59 | 9% | 24% |

41 | Luton | £300,300 | 1.1% | 37 | 9% | 25% |

42 | Newport | £209,500 | 2.4% | 36 | 10% | 27% |

43 | Worcester | £301,500 | 2.2% | 29 | 9% | 26% |

44 | Galashiels | £186,600 | 4.7% | 35 | 8% | 28% |

45 | Kirkwall | £164,800 | 3.0% | 41 | 10% | 29% |

46 | Stevenage | £404,000 | 1.3% | 43 | 8% | 24% |

47 | Wakefield | £181,700 | 2.8% | 36 | 10% | 24% |

48 | Dudley | £229,700 | 2.4% | 40 | 9% | 26% |

49 | Doncaster | £164,700 | 1.7% | 40 | 10% | 29% |

50 | Stockport | £288,200 | 2.9% | 40 | 8% | 28% |

51 | Halifax | £184,200 | 3.7% | 35 | 12% | 25% |

52 | Blackpool | £156,400 | 2.5% | 42 | 9% | 30% |

53 | Romford | £374,300 | 0.7% | 41 | 11% | 18% |

54 | Teesside | £138,000 | 2.2% | 38 | 12% | 25% |

55 | Reading | £413,400 | 0.5% | 35 | 11% | 22% |

56 | Darlington | £157,200 | 2.3% | 36 | 11% | 28% |

57 | Telford | £226,800 | 0.8% | 42 | 7% | 32% |

58 | Sutton | £456,000 | 0.3% | 36 | 11% | 20% |

59 | Bath | £329,600 | 0.0% | 35 | 12% | 23% |

60 | Hebrides | £156,800 | 1.4% | 40 | 10% | 59% |

61 | Gloucester | £328,100 | 0.8% | 34 | 10% | 27% |

62 | Dartford | £375,100 | 0.6% | 43 | 11% | 20% |

63 | St Albans | £521,800 | 1.0% | 43 | 9% | 26% |

64 | Uxbridge | £423,800 | 0.3% | 48 | 6% | 32% |

65 | Enfield | £444,300 | 0.7% | 41 | 7% | 29% |

66 | Harrogate | £340,700 | 0.5% | 38 | 10% | 28% |

67 | Shrewsbury | £264,000 | 1.4% | 47 | 9% | 38% |

68 | Nottingham | £214,200 | 0.8% | 35 | 13% | 25% |

69 | Huddersfield | £195,800 | 2.1% | 38 | 12% | 26% |

70 | Chester | £217,000 | 2.6% | 44 | 12% | 27% |

71 | Medway | £310,900 | 0.5% | 40 | 14% | 21% |

72 | Derby | £225,000 | 2.3% | 42 | 10% | 28% |

73 | Oxford | £411,100 | 0.9% | 41 | 12% | 25% |

74 | Cambridge | £407,900 | 0.1% | 42 | 11% | 24% |

75 | Salisbury | £338,100 | 1.0% | 45 | 10% | 25% |

76 | Ipswich | £289,700 | 0.3% | 47 | 11% | 27% |

77 | Lancaster | £224,700 | 1.3% | 39 | 11% | 31% |

78 | York | £260,000 | 1.3% | 39 | 10% | 35% |

79 | Lincoln | £214,800 | 1.8% | 48 | 10% | 40% |

80 | Plymouth | £250,700 | 0.7% | 51 | 12% | 31% |

81 | Hereford | £295,400 | 1.5% | 46 | 9% | 37% |

82 | Taunton | £280,000 | 0.8% | 42 | 10% | 34% |

83 | Southampton | £333,100 | -0.2% | 38 | 12% | 28% |

84 | Southend-on-Sea | £344,800 | 1.0% | 45 | 13% | 22% |

85 | Llandudno | £206,000 | 1.7% | 53 | 11% | 44% |

86 | Ilford | £441,600 | 0.5% | 49 | 11% | 26% |

87 | Swansea | £196,400 | 2.3% | 49 | 12% | 37% |

88 | Hemel Hempstead | £448,800 | 1.0% | 44 | 10% | 27% |

89 | Peterborough | £244,000 | 0.2% | 40 | 11% | 34% |

90 | Redhill | £437,600 | 0.3% | 44 | 12% | 26% |

91 | Colchester | £295,900 | -0.1% | 44 | 13% | 27% |

92 | Llandrindod Wells | £251,000 | 2.4% | 51 | 10% | 44% |

93 | Watford | £488,100 | 0.4% | 62 | 10% | 28% |

94 | Kingston upon Thames | £583,900 | -0.3% | 41 | 11% | 28% |

95 | Chelmsford | £408,500 | 0.6% | 41 | 11% | 26% |

96 | Norwich | £260,300 | 0.1% | 42 | 15% | 30% |

97 | Bromley | £515,700 | 0.2% | 46 | 14% | 24% |

98 | Aberdeen | £161,100 | 0.5% | 40 | 17% | 34% |

99 | North London | £578,000 | 0.2% | 44 | 12% | 27% |

100 | Exeter | £305,000 | -1.7% | 42 | 12% | 39% |

101 | South East London | £464,200 | -0.5% | 51 | 14% | 30% |

102 | Slough | £493,600 | -0.5% | 50 | 10% | 33% |

103 | Portsmouth | £291,800 | -1.1% | 41 | 13% | 32% |

104 | Guildford | £468,500 | 0.3% | 49 | 14% | 26% |

105 | East London | £472,600 | -0.6% | 42 | 13% | 32% |

106 | Croydon | £397,300 | -0.3% | 47 | 14% | 28% |

107 | Twickenham | £503,000 | 0.4% | 50 | 11% | 30% |

108 | Harrow | £505,300 | -0.3% | 50 | 11% | 33% |

109 | Truro | £311,300 | -2.4% | 54 | 12% | 42% |

110 | Bournemouth | £343,600 | -1.8% | 48 | 12% | 36% |

111 | Dorchester | £319,600 | -1.3% | 43 | 13% | 33% |

112 | Canterbury | £298,400 | -1.2% | 59 | 18% | 32% |

113 | Torquay | £286,100 | -1.9% | 51 | 14% | 41% |

114 | Brighton | £367,600 | -1.1% | 36 | 15% | 29% |

115 | Tunbridge Wells | £401,400 | -0.6% | 50 | 14% | 34% |

116 | North West London | £621,700 | -2.0% | 53 | 12% | 39% |

117 | South West London | £706,900 | -0.8% | 50 | 15% | 36% |

118 | East Central London | £682,400 | -4.5% | 67 | 14% | 47% |

119 | West London | £747,100 | -1.5% | 54 | 14% | 43% |

120 | West Central London | £797,600 | -1.8% | 82 | 14% | 51% |

These are affordable markets where homes sell quickly and buyer demand is strong. This creates headroom for prices to continue rising at an above-average pace.

Buyer demand is resilient and broad-based

Homes are selling faster than the UK average

Pricing accurately still matters, but market momentum supports sellers.

At valuations, emphasise the strength of your market with sellers securing strong interest and smooth sales. Show evidence of recent achieved prices, highlight speed of sales as a sign of demand strength, and explain how realistic pricing secures competition and avoids lost momentum. Reassure homeowners that they’ll be selling into existing demand - not waiting for it.

These are balanced markets with steady demand and normal selling times. Prices can rise gradually, but only where homes are priced realistically from the outset.

Demand exists, but it’s value-driven

Longer selling times are normal

Price cuts common when the initial pricing is set too high

Achieved prices depend on first impressions and listing quality

When pitching to clients, get across the benefit of pricing competitively to attract early demand. Explain that the market is adjusting to higher mortgage rates and reduced buying power, which makes buyers price-sensitive while they also have more choice, and the risk of overpricing can lead to a slower sale and a weaker final price. Demand has not disappeared - it is simply more selective - and the right sales strategy will protect the final result.

Housing markets across Southern England and London make up the list of the areas at the bottom of the rankings across the UK. This is largely down to affordability pressures resulting from higher house prices and the fact the market is still adjusting to higher mortgage rates. These markets have also seen a greater increase in homes for sale, boosting buyer choice, and with higher stamp duty costs since April 2025. This explains the modest decline in average prices over the last year.

These higher-priced markets make buyers more cautious, lengthening sale times. Price growth is slower and sellers need to adjust expectations to secure a sale.

Buyers are active but selective

Well-priced homes still attract good interest

Overpriced homes sit and then underperform

Micro-location matters more than headline trends

Show evidence of recent achieved prices and use sale speeds to show demand strength in your local area. Realistic pricing will secure competition and avoid lost momentum, particularly in a steady market. It’s a workable market, not a weak one, and that’s where the right pricing and marketing strategy matter most. Homes that are well-presented and priced realistically will continue to sell, but optimistic pricing might take longer and require later reductions, which can be detrimental to the final result.

We try to make sure that the information here is accurate at the time of publishing. But the property market moves fast and some information may now be out of date. Zoopla accepts no responsibility or liability for any decisions you make based on the information provided.

The Zoopla House Price Index shows renewed activity in the housing market, presenting immediate opportunities to build instruction volumes and sales pipelines.

Read more

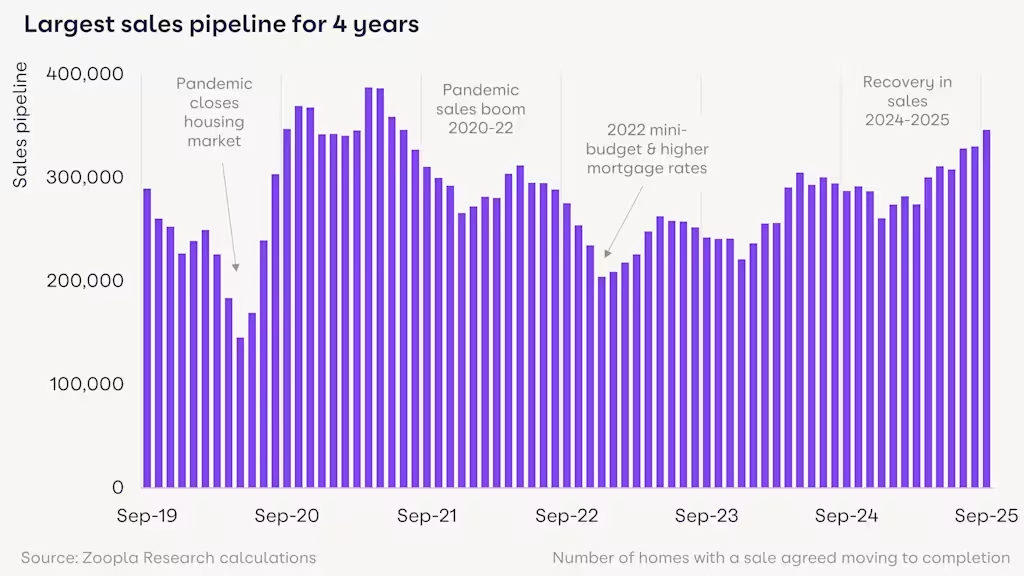

The UK sales market has registered a strong recovery over the last two years, with agents now managing the largest sales pipeline since 2021.

Read more

Rental growth slows to 2.2% as supply rises and demand drops to 6-year low.

Read more