Renewed market momentum fuelled by improving mortgage market

25 Feb 2026The Zoopla House Price Index shows renewed activity in the housing market, presenting immediate opportunities to build instruction volumes and sales pipelines.

Read more

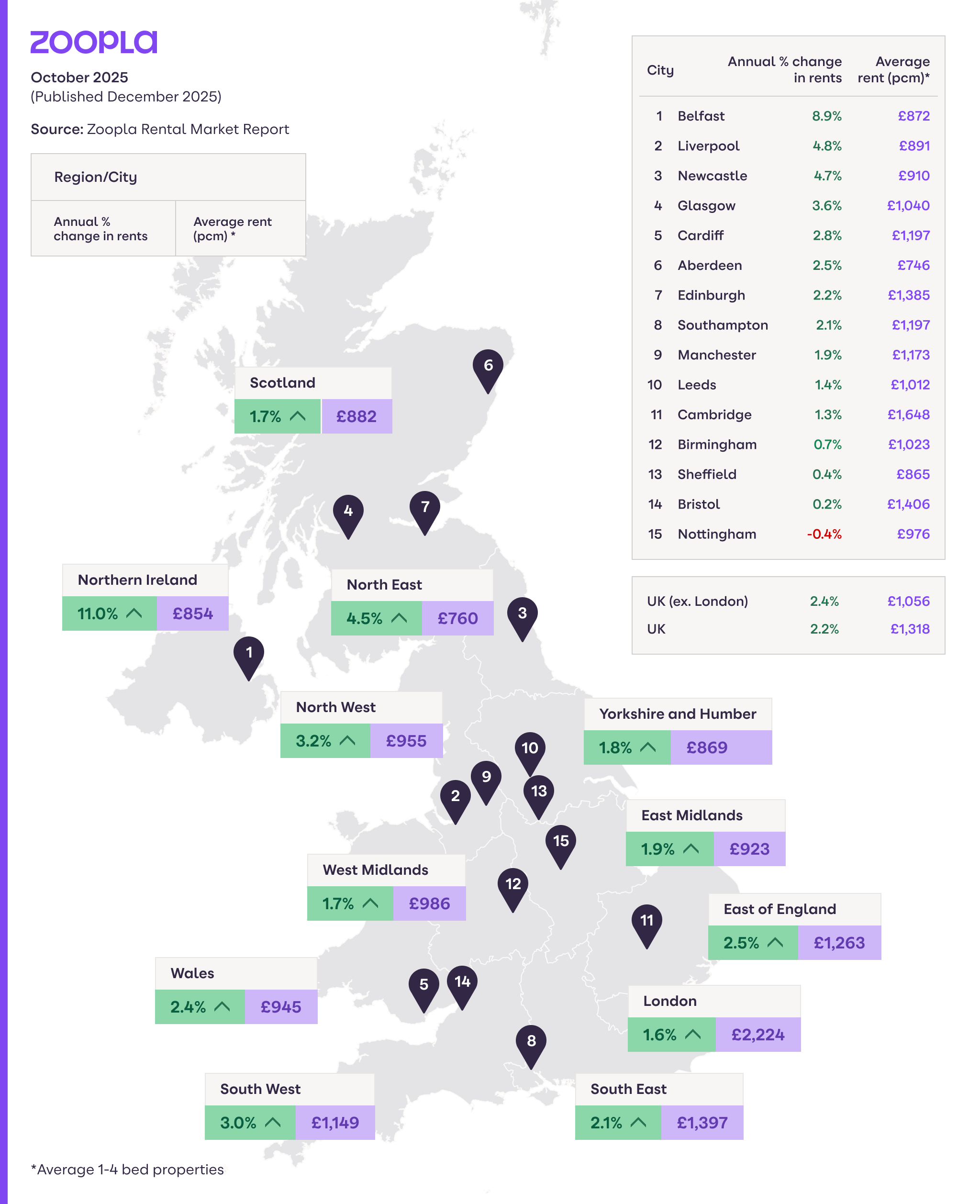

Rental growth slows to 2.2% as supply rises and demand drops to 6-year low.

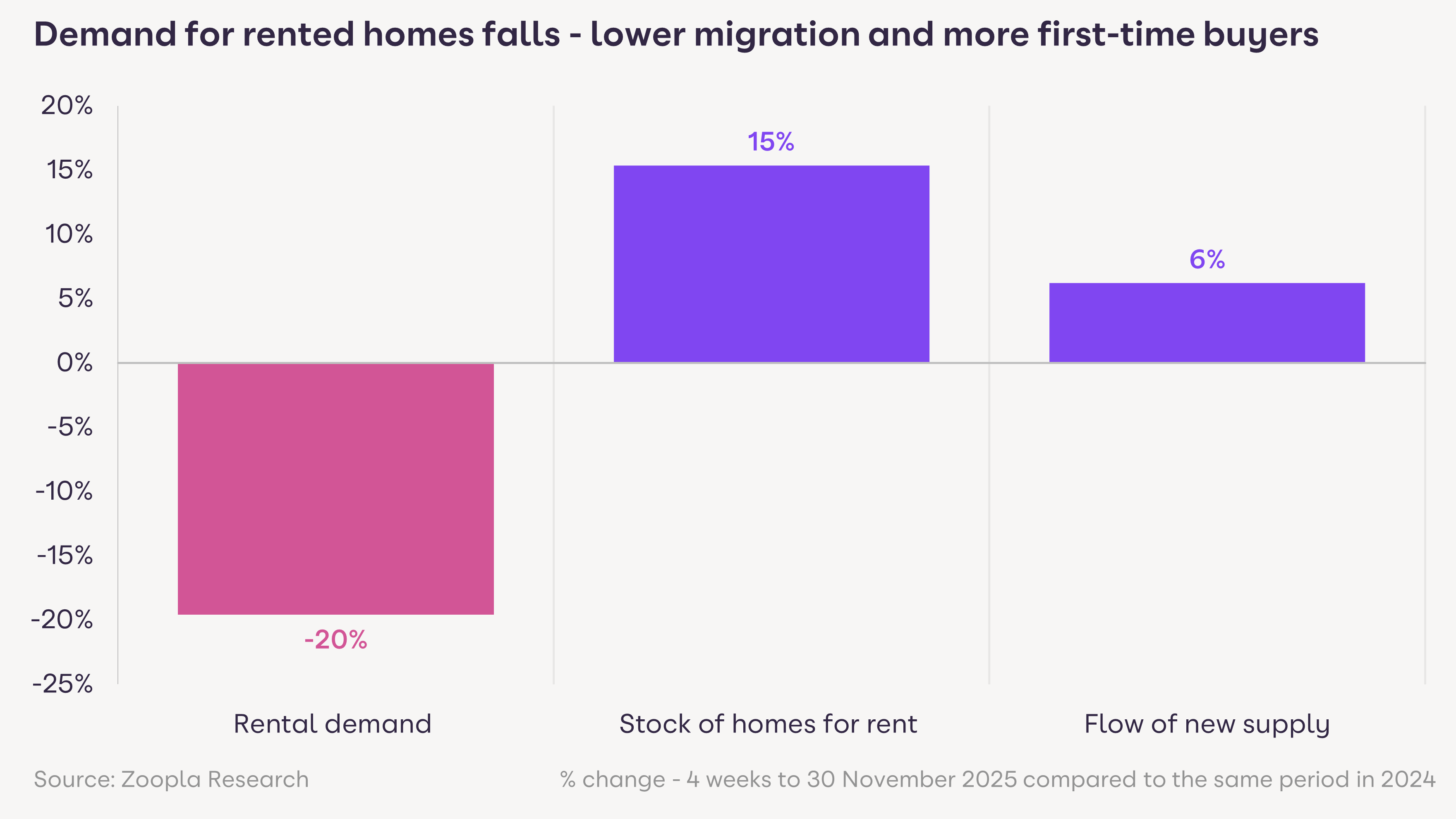

Tenant demand has fallen by a fifth over the last year and is the lowest it’s been at this time of year for 6 years.

Rental supply is up 15% with more stock freeing up due to lower migration and more first-time buyers.

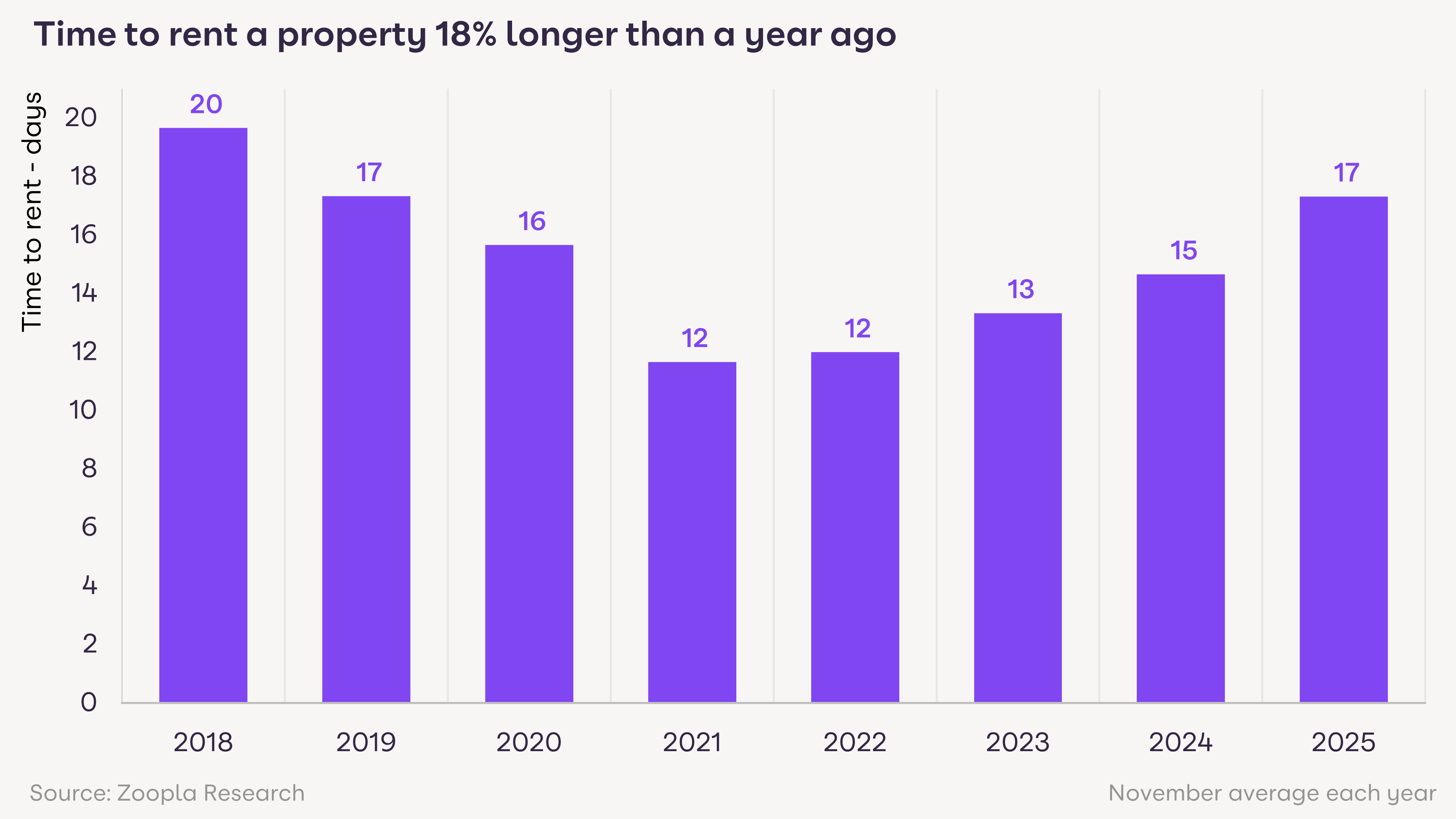

Time to let stretches to 17 days, almost 20% slower than a year ago.

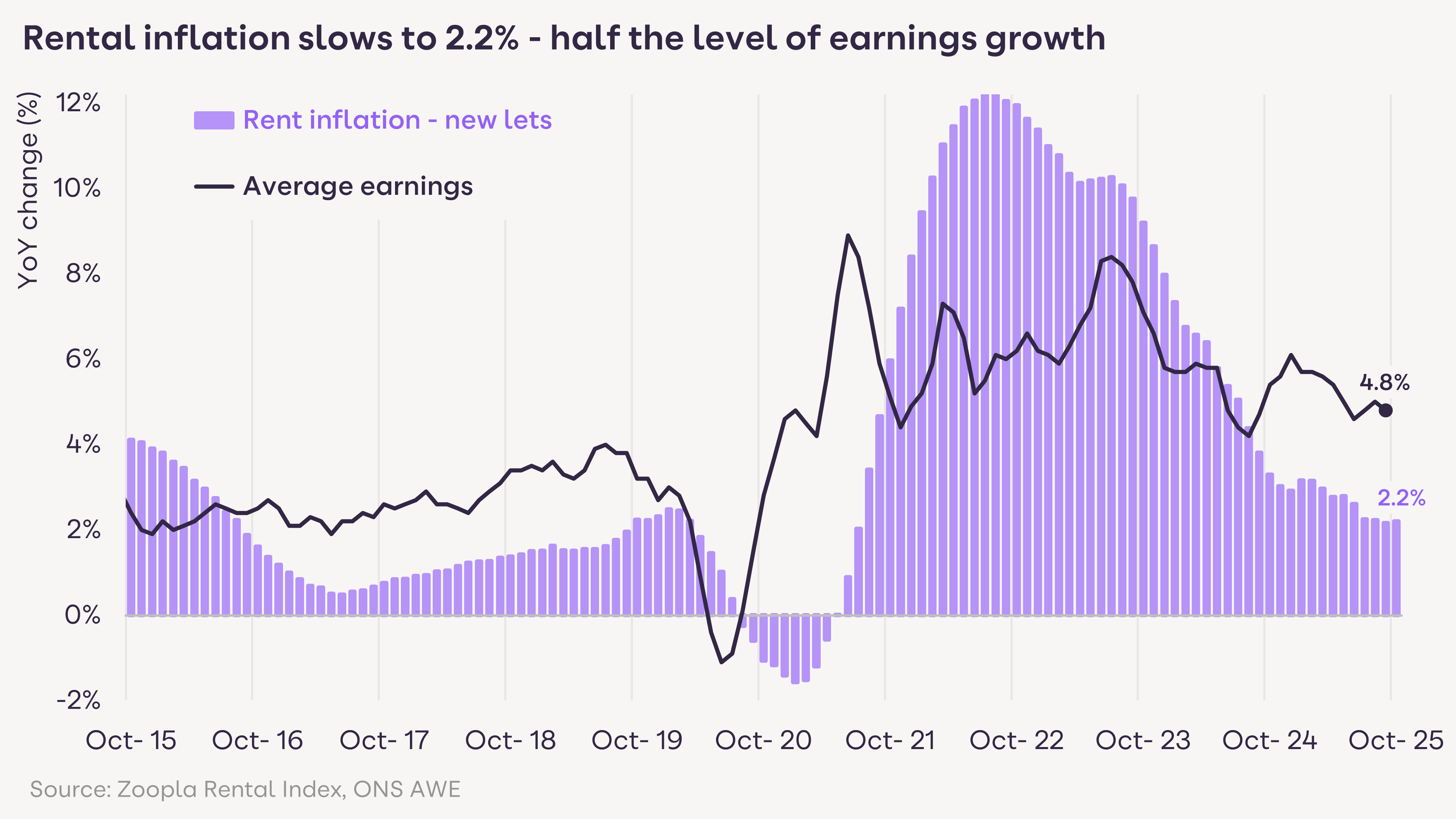

UK rents have risen 2.2% over the last 12 months, the slowest rate for 4 years.

Our 2026 rental growth forecast is 2.5%, indicating steady and sustainable returns for landlords.

The average rent for new lets in the UK is £1,320 (or £15,840 a year) as of December 2025 (data to October 2025).

Rents have risen 2.2% in the last year, down from 3.3% a year ago and the slowest rate of growth in 4 years.

The narrowing supply and demand gap sees demand down by a fifth in the last year with supply up by 15%.

Download the Rental Market Report December 2025 (PDF, 305kB)

Rental demand is down by a fifth compared to last year and at its lowest level for this time of year in 6 years. There are two key factors playing into this.

A large decline in net migration is having the most significant impact on demand. Many people coming to the UK to work and study look to the rental market for their housing needs.

New ONS estimates show a 78% decline in net migration over two years: from 924,000 people in the year to June 2023 to 204,000 in the year to June 2025. This drop in migration is having a direct impact on the level of rental demand across the country.

A secondary factor in lower rental demand is improved mortgage affordability for first-time buyers. The UK is on track for more than 350,000 people to buy their first home in 2025, and there has been a 20% increase in the number of first-time buyer mortgages in the 9 months to September (UK Finance).

Many first-time buyers were previously renters, so more rental homes are being freed up. While this trend is helping ‘better off’ renters to buy, most households on lower incomes have private renting as their only housing option.

With a tightening tenant pool, assure landlords of your robust marketing channels and ability to secure high-quality tenants from the remaining supply, highlighting the value of your broad network, listing visibility and efficient tenant-check processes.

Tap into our well-known brand, unique audiences and pipeline of motivated movers.

Rents usually rise in line with earnings over the long run. However, 2022-23 saw a rapid rise in rents which outstripped the growth in average earnings. This stretched rental affordability to its limits.

Rents are now rising more slowly than earnings growth. We expect this to run into 2026 and help repair affordability for renters across the UK.

This trend can be a positive message for landlord retention. The market is moving towards more sustainable and predictable growth, which can help reduce tenant turnover and the associated costs, thereby protecting long-term investments.

A shortage of homes for rent has defined the market in recent years. It’s pushed rents higher and stretched affordability across the rental market.

But supply is recovering, with national rental supply 15% higher than a year ago and the average estate agency branch marketing 14 homes for rent. This is up from a supply low of 8 in 2022, but still under the pre-pandemic average of 17.

The increased supply means tenants now have greater choice. This emphasises your role in advising landlords on property standards, maintenance and effective presentation to ensure their property stands out against increased competition.

Availability is up by more than 20% in the North West, North East, South West and Wales reflecting the stronger first-timer buyer activity in these regions. More rentals are freed up from this, alongside homes that fail to sell being placed on the rental market.

Supply is slower in London (6%) and Scotland (9%), which will keep more pressure on rental rates. In London, weak landlord economics - high purchase costs and low rental yields - are prompting continued sales of rental homes. Nearly a third of homes for sale in the capital (31%) are former rentals, which is almost 3 times the average across the rest of the country (12%).

The time it takes for a property to rent is a key barometer of rental market health. It shows how supply and demand are shifting in real-time.

The time to rent has increased, with homes staying on the market for 17 days before being rented over the last 3 months. This is almost 20% slower than a year ago, and 42% slower than the pandemic boom in rental demand. The time to rent has increased across all regions and countries of the UK, with the average across regions ranging from 14 days in Scotland to 19 in the West Midlands.

Focusing on the financial impact of void periods is an effective way to communicate your value to a landlord, and your expertise in reducing these should be a key point in pitches. Data-driven pricing, superior marketing and efficiency administration processes can help protect landlords’ returns by reducing the average time to let and any associated void periods.

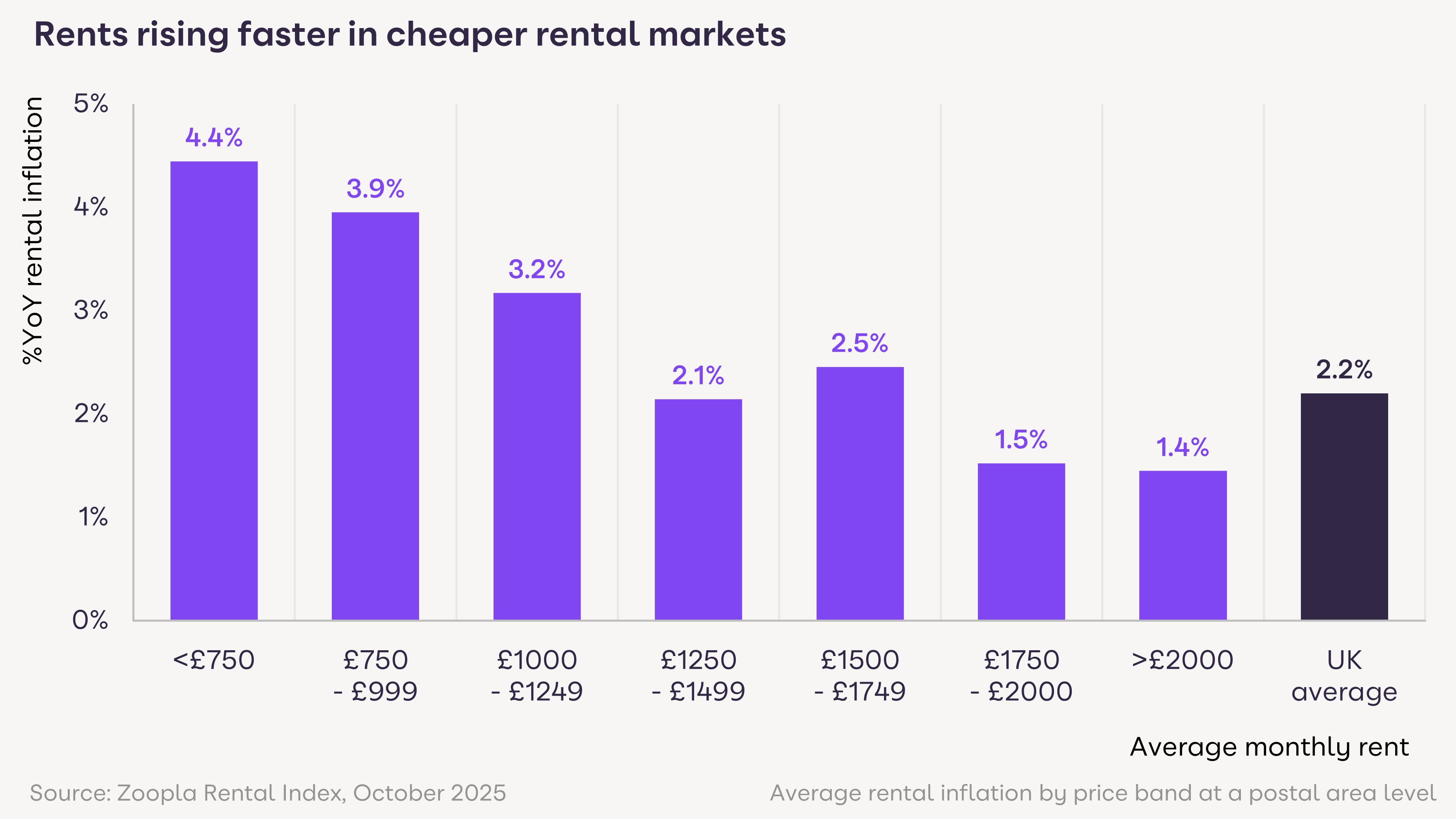

There has been a slowdown in rental inflation across all regions and countries of Great Britain due to the leveling of supply and demand.

At a regional level, rents are rising fastest in the North East (4.5%) and the North West (3.2%). In terms of local markets, the strongest rental growth is in Carlisle (8.1%), Chester (7.4%) and Motherwell (7%). These are lower-value markets where affordability leaves more headroom for rent increases.

Regional rents are rising most slowly in London (1.6%), the West Midlands (1.7%) and Scotland (1.7%). Some local markets are seeing rents fall, including Birmingham (-1.5%) and Dundee (-1%). Many of these are higher-value areas where stretched affordability is limiting further rises.

These differences reflect local shifts in supply and demand, as well as the affordability of rents relative to local incomes.

The rental market is shifting back towards more ‘normal’ levels of activity, which supports sustainable levels of rent rises. A modest supply/demand imbalance remains, which will keep rents rising gradually: we expect rents to rise by 2.5% in 2026.

New investment from landlords remains limited and the number of rented homes is broadly unchanged for a decade, with little prospect of near-term growth. The forecast of stable 2.5% growth can provide confidence to existing clients, and your role becomes even more paramount in navigating regulations and legislative changes to retain landlords and attract new portfolios.

Slower rental inflation is a reflection of both weaker demand and stretched affordability, but many low-to-middle income renters will always rely on the rental sector. This core group will play a key role in determining how much rents can rise in the years ahead.

We expect rental affordability across the UK to return to pre-pandemic levels in the coming year. This will improve choice for tenants and help to contain rental inflation at more affordable levels.

Our Rental Market Index is a repeat transaction index, based on asking rents and adjusted to reflect achieved rents. The index is designed to accurately track the change in rental pricing for UK housing.

Notes on this month's data:

UK rents increased by 2.2% over the last 12 months: in the 4 weeks to 30 November 2025 vs same period in 2024.

The migration figures are ONS data for long-term international migration, provisional: year ending June 2025.

First-time buyer numbers are UK Finance data: Year-on-year change in first-time buyer loans, January to September 2025 vs same period in 2024.

Rental supply is our analysis of homes for sale and previously rented, covering sales listings in Q3 2025.

Time to rent is our analysis of time to rent for rental listings, 3-month average to November 2025.

We try to make sure that the information here is accurate at the time of publishing. But the property market moves fast and some information may now be out of date. Zoopla accepts no responsibility or liability for any decisions you make based on the information provided.

The Zoopla House Price Index shows renewed activity in the housing market, presenting immediate opportunities to build instruction volumes and sales pipelines.

Read more

Richard Donnell explores the important property tax changes announced in the Autumn Budget, breaking down which markets will be hit and how to support clients.

Read more

Our new research shows that while the industry may be busy polishing its automation tools, sellers are gently reminding everyone that property decisions are still deeply personal - although this does vary across groups of consumers.

Read more