Zoopla House Price Index: November 2025

28 Nov 2025House prices fall for the first time in 18 months across southern England, but threat of new property tax removed from 210,000 homes.

Read more

Stamp duty speculation may not signal change, but it creates opportunities for proactive agents to guide buyers and sellers.

Lower upfront costs could boost buyer activity in the £250k–£500k range, creating more leads for agents

Higher-value homes may see more frequent moves as owners manage long-term tax exposure in the long run, opening opportunities for sales

Agents who advise homeowners on possible changes and the current situation on stamp duty could add value and strengthen client trust

The housing market has been on a great run over the last 2 years with sales agreed rising steadily.

However, uncertainty over possible tax changes in the Budget means market activity is slowing.

Recent speculation about scrapping stamp duty in favour of an annual property tax has captured headlines, as well as a possible revaluation of council tax bands and charging capital gains tax on property sales. Speculation over tax changes is an annual occurrence and nothing may change.

For estate agents, the real story isn’t just about taxes, it’s about unlocking transactions today and new revenue potential in future.

Talk of replacing stamp duty with an annual property levy is generating noticeable interest among buyers, particularly in the mid-market. While any policy change remains uncertain, the discussion itself presents a clear opportunity for agents to engage with consumers and build trust.

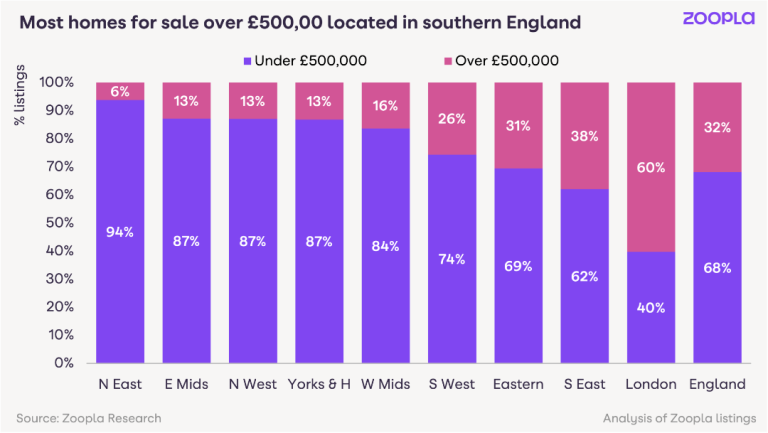

Research shows that a buyer purchasing a £300,000 home could save around £5,000 upfront if such a scheme were introduced, as no annual tax would apply at that level. Homes above £500,000 would begin to attract a yearly charge, estimated at £2,700 for a £500,000 property, £8,180 for £1 million, and £12,270 for £1.5 million. Over 20 years, that could equate to roughly 10% of a property’s value in tax for top-end homes.

Estimated annual property tax impact (Zoopla research):

Property value | Estimated annual tax | When it costs more than stamp duty land tax | Total impact over 20 years |

£300,000 | £0 | N/A | Saves £5,000 upfront |

£500,000 | £2,700 | After 6 years | Moderate long-term cost |

£1,000,000 | £8,180 | After 5 years | Significant extra cost |

£1,500,000 | £12,270 | Immediate | ~£150,000 more over 20 ye |

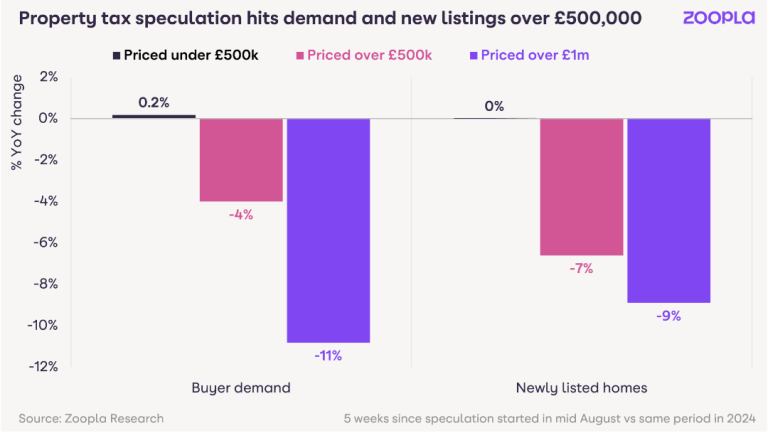

Rather than signalling immediate change, this discussion is prompting buyers to pause and consider their next move. Recent data shows enquiries for homes over £500,000 have dipped 4%, and 11% for properties above £1 million, with listings in the £1 million+ range down 9%.

For agents, the opportunity lies in guiding serious sellers through this uncertainty and helping buyers make informed decisions. Engaging proactively can help maintain confidence in the market, encourage thoughtful moves, and reinforce the agent’s role as a trusted advisor - even if the rules themselves remain unchanged.

More active buyers: Lower upfront costs could encourage buyers who have been waiting on the sidelines to re-engage. Agents who understand the nuances of the new tax landscape can advise clients strategically; whether on timing moves or understanding long-term tax implications.

Upselling expertise: Annual taxes introduce new calculations for buyers and sellers alike. Agents can become indispensable by modelling scenarios, highlighting value, and offering bespoke advice on purchase timing, downsizing, or upsizing.

Market differentiation: Those agents who embrace reform early and communicate the benefits clearly could capture market share. It’s a chance to position your agency as an authority on navigating the next era of property transactions.

Discover our powerful agent tools, designed to help you boost brand visibility and attract more business.

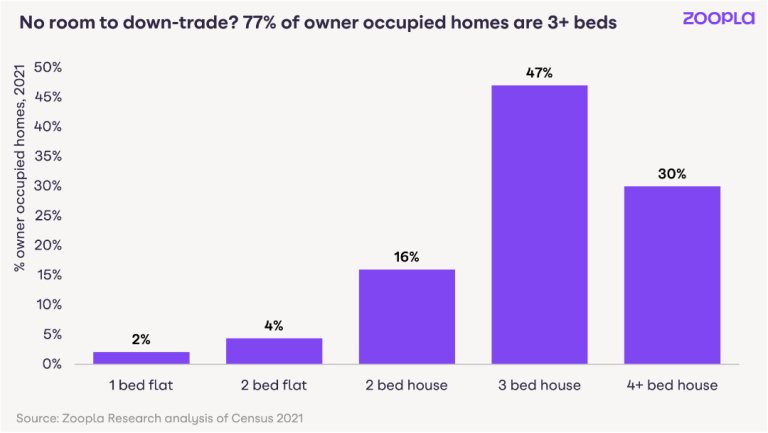

One caveat: unlocking moves is only half the story. The UK housing market has a chronic shortage of smaller homes, which could limit downsizing options for some households.

Agents who can identify or even incentivise alternative property solutions, such as new-builds, conversions, or multi-generational arrangements, will be best placed to benefit from reform-driven mobility.

Uncertainty may dominate headlines in the short term, but there’s a bright horizon for estate agents who think strategically.

Well-implemented reform could make moving easier, encourage more frequent transactions, and ultimately increase agency revenues.

For those willing to adapt, educate clients, and navigate the changing market with confidence, the coming years could prove highly profitable.

In other words, property tax reform isn’t just a story about policy, it’s a story about opportunity. The agents who act first, and act smart, will be the ones who thrive.

Get your ads on Zoopla today.

We try to make sure that the information here is accurate at the time of publishing. But the property market moves fast and some information may now be out of date. Zoopla accepts no responsibility or liability for any decisions you make based on the information provided.

House prices fall for the first time in 18 months across southern England, but threat of new property tax removed from 210,000 homes.

Read more

We’ve launched a major initiative for the new homes market, showcasing our ongoing innovation to actively promote new-build properties and their benefits.

Read more

First-time buyers are driving nearly 40% of all property sales. With stronger affordability and bigger budgets, they’re reshaping demand across the UK. See the latest trends and how we can help you connect with them.

Read more