New property tax on the highest value homes

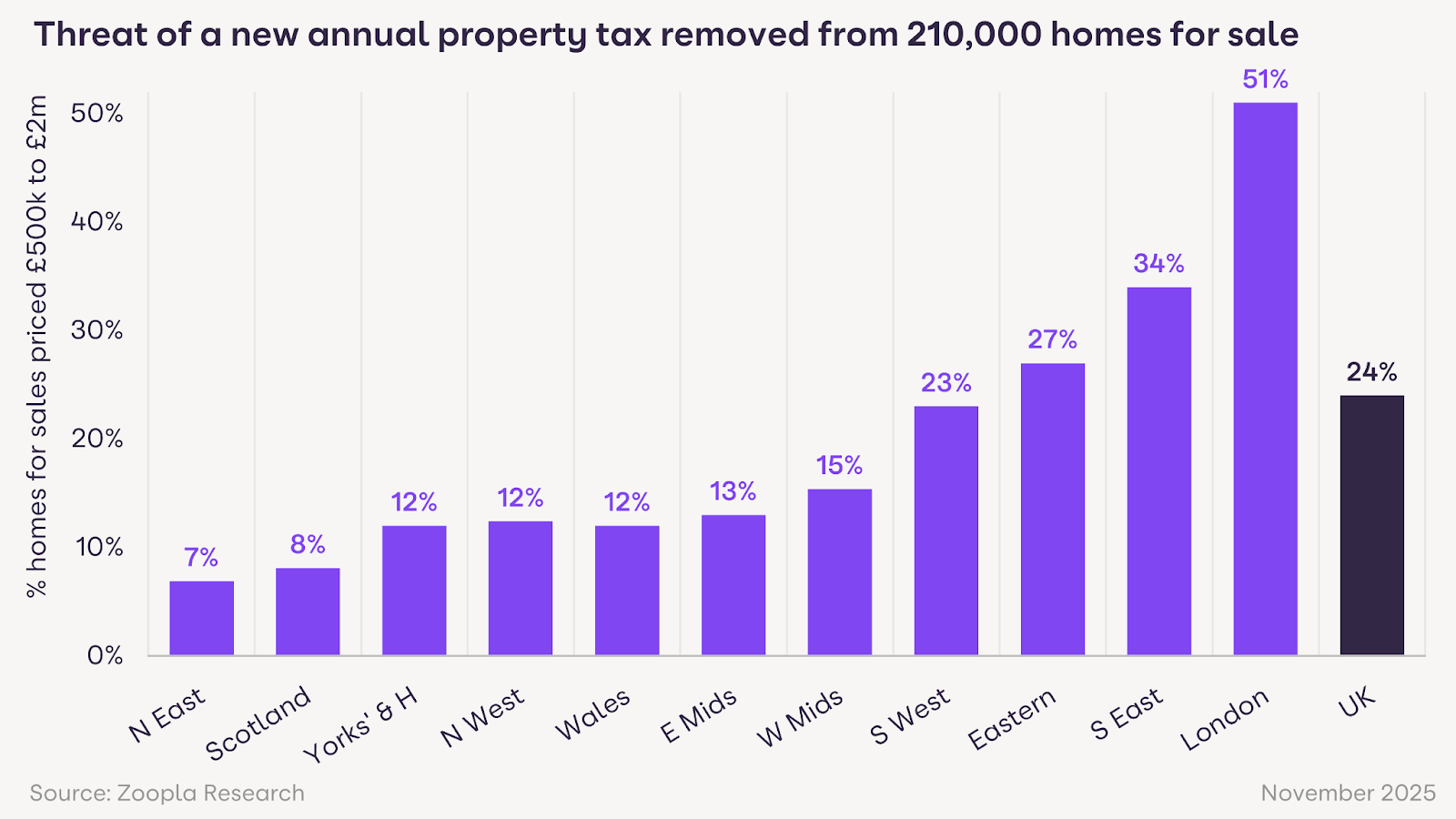

As widely trailed, the Government is going to charge a Council Tax High Value Supplement on homes worth £2m or more in England. This will hit around 0.5% of homes and homeowners. Our data shows that 85% of these properties are in the highest value areas of London and the South East.

The Chancellor reported an annual additional cost of around £2,500 a year for homes worth £2m, rising to £7,500 a year for homes over £5m. For a £2m home, this is less than double the average council tax today and is less than many feared.

How much this creates a cliff edge around the £2m price band remains to be seen and the impact will depend on how this new scheme is rolled out.

While home sales over £2m account for just 0.6% of sales, these homes generate over 20% of stamp duty tax receipts. There is a risk that there may be fewer sales in the short term, but it may also see more sales as homeowners look to mitigate the additional costs.